I would like to start out with a snippet from the 1993 film Schindler’s List.

We were on the roof on Monday, young Lisiek and I and we saw the Herr Commandant come out of the front door and down the steps by the patio right there below us and there on the steps he drew his gun and he shot a woman who was passing by. A woman with a bundle, through the throat, just shot her. Just a woman on her way somewhere, you know, she was no fatter or thinner or slower or faster than anyone else and I couldn't guess what she had done. The more you see of the Herr Commandant, the more you see there are no set rules that you can live by. You can't say to yourself, "If I follow these rules, I will be safe."

For me, nothing captures my feelings toward the stock market better than the above quote. The stock market, in the form of Herr Commandant, has power. It can do things at will. It has its own behavior. But that behavior is no longer something that can be understood. It simply does what it does, without any clear basis in rational thought, and we can either participate as willing collaborators, rationality be damned, or we can stand back in abject puzzlement and horror. I’m kind of in the horror camp.

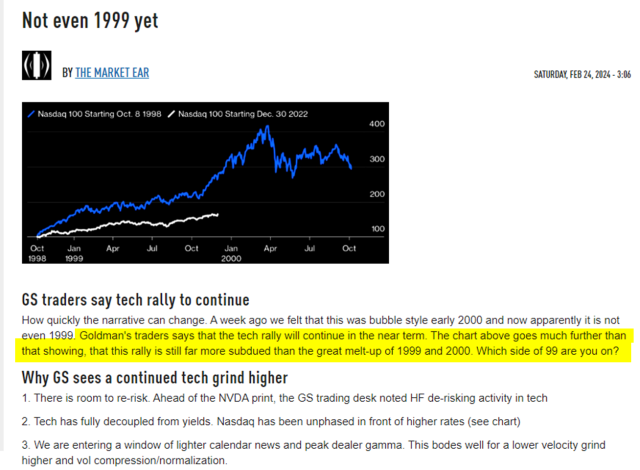

Zerohedge, once a rare bastion of critical thought and analysis, decided a couple of years ago to morph into little more than a cheerleading shill for Goldman Sachs. Most of their content is along the lines of “Goldman Says This” and “Goldman Says That“, and even on a weekend, I am faced with an article declaring the latest “Goldman Says” tripe, which is that this tech rally is only just getting STARTED.

They offer up the chart below, meant to emphasize how puny, modest, and young the current rally is (white line) versus the kooky blue line that those zany fellas back in the late 1990s were trading. The message here: if you think the NASDAQ is hot now, just wait until it is three times bigger in a year or so.

Do I honestly have to state how preposterous it is to compare the year 1998 to the year 2022? Does ANYONE here really need to think deeply to consider how much potential energy existed in the tech world in 1998 versus now? Honestly? In 1998:

- Internet adoption was a tiny fraction of today;

- Even the most basic smart phone was almost a decade away;

- Almost all the Internet companies we use today didn’t even exist yet;

- The United States was running a SURPLUS (yes, a SURPLUS) and had a serious plan to be DEBT FREE in about a decade (news flash: we are $35 trillion in debt now)

I could go on and on, but why bother? If you don’t think the above analog is stupid beyond belief, you should probably be hanging out on Yahoo Finance instead.

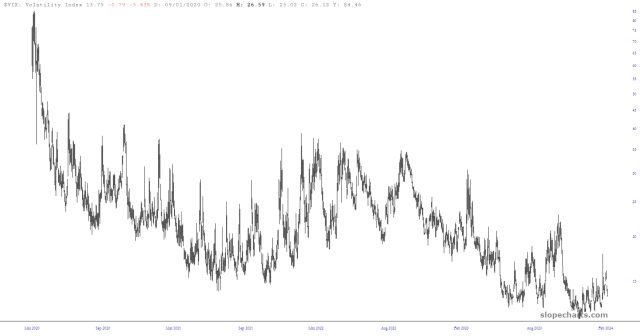

This kind of thinking from the likes of ZH is working, though. One glance at the VIX, showing that volatility has absolutely been smothered to death, proves the point. Uncertainty is dead. Volatility is dead. Organic markets are dead.

As Goethe told Itzhak Stern: “Look at me. I want to know who you work for now.”