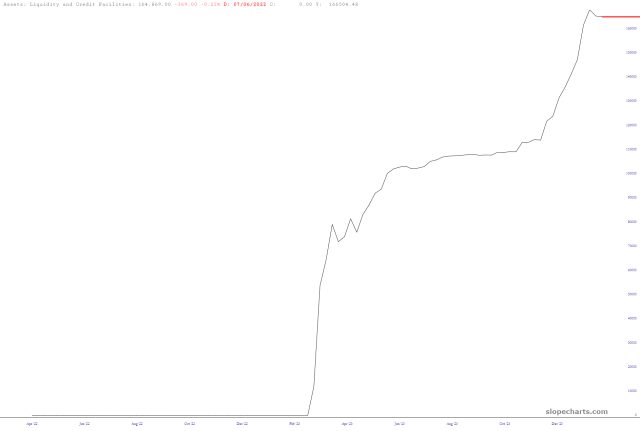

It’s end-of-day Thursday, which means the latest liquidity-oriented data from our friends at the FOMC has tumbled out. Let’s thumb through it. We’ve got Yellen’s BTFP program, which ostensibly is just a few weeks ago from being shuttered to any new lending:

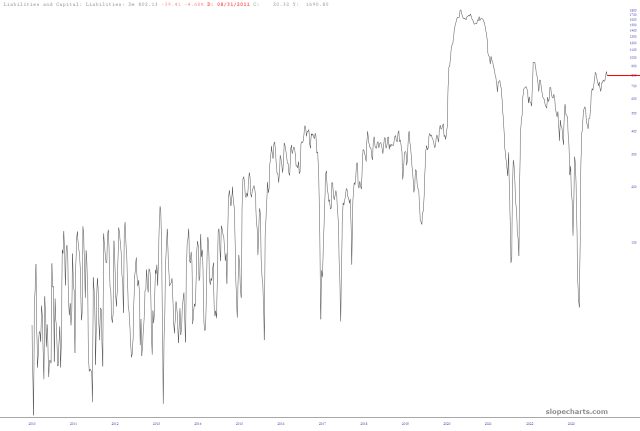

Then there’s her Treasury account:

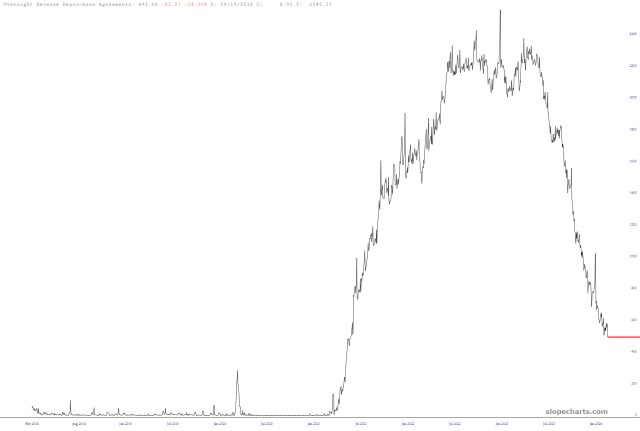

The once-mighty and now-plunging Reverse Repo:

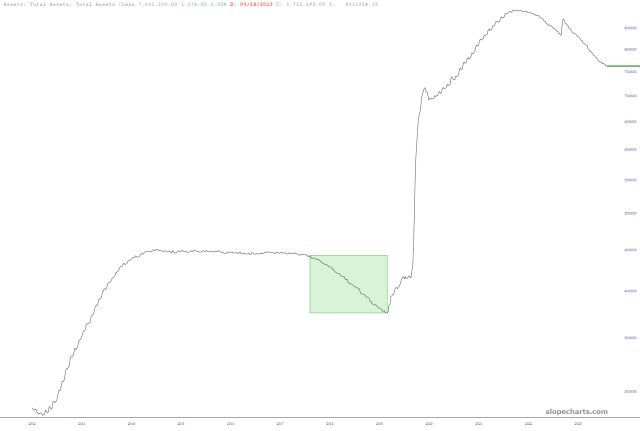

And, finally, the Fed Assets balance, which has been in QT mode (to no ill effect for the bulls) for a long while now, although this week is was pretty close to unchanged.

Boil it all up and put it through the new Fed Spread, and we get the following……….

Frankly, I think the Fed’s “plumbing” has become so inscrutable at this point, my brain is tied in knots just trying to examine this stuff. Until the BTFP is fully drained, the S&P seems artificially propped to the heavens.