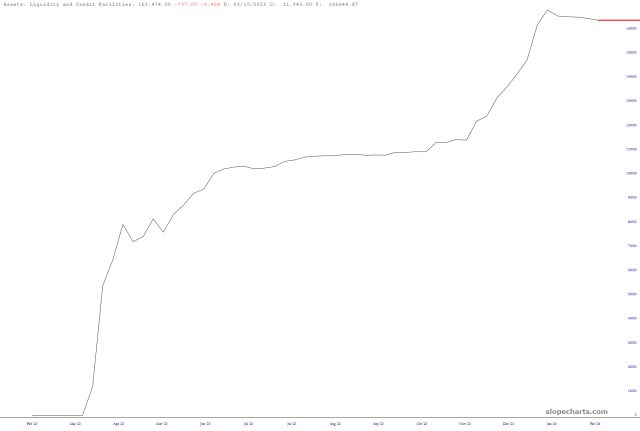

Let’s look at the latest from the Fed. Here we see the BTFP program, which shutters its doors in just a little more than a week. What a different a year has made, huh? The banks gobbled up hundreds of billions of dollars of free money, and they only stopped when the Fed FINALLY stopped paying them above-market interest rates (that is to say, free money). That’s why we’ve flat-lined for the past few weeks. Anyway, please note that the BTFP closure doesn’t mean they all pay their money back. It merely means they can’t ask for even-more-hundreds-of-billions anymore, at least until the next government creation.

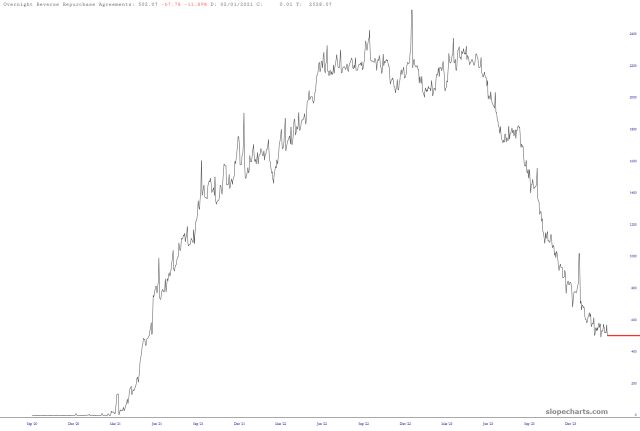

The Reverse Repo is spiraling toward a $0 balance. I’ve tried my best to grasp the Fed plumbing, but I’m not sharp enough to really figure it out. I can merely say that it sure looks like a $0 balance is coming up this spring.

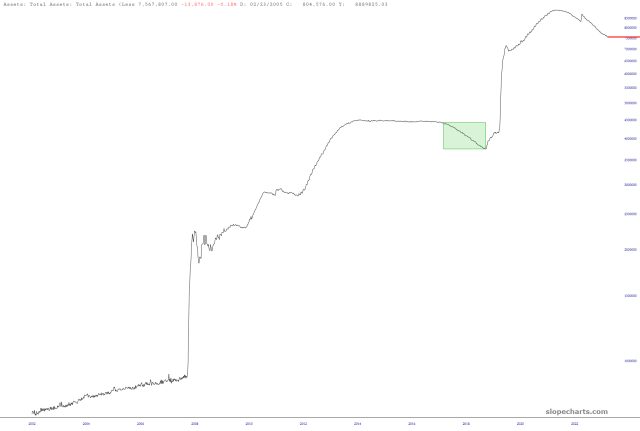

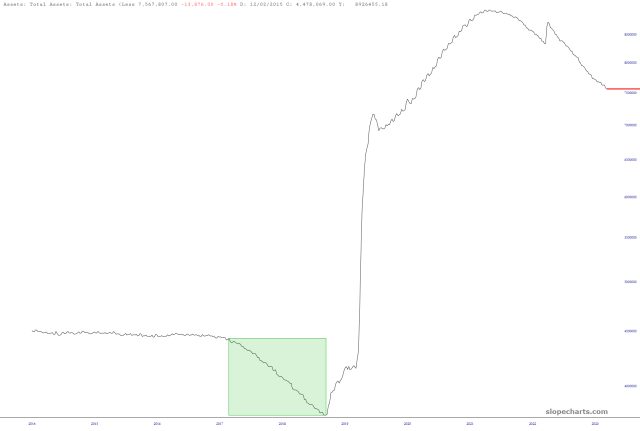

The Fed continues to shrink its balance sheet with no ill effects on the market.

Of course, this is just a modest shave considering the trillions they’ve scarfed down since they decided to take over the stock market in early 2009.