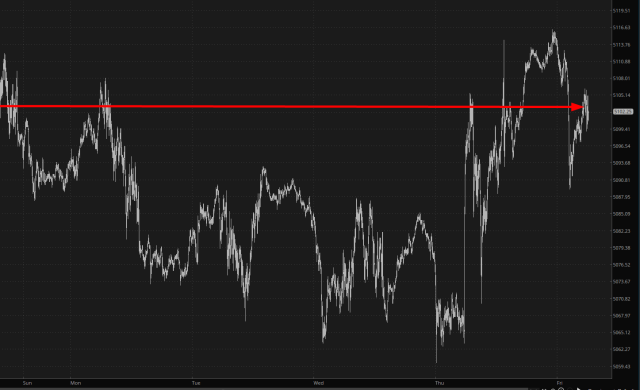

It probably doesn’t behoove me to bellyache and whine about the market, but at this point, I can’t help myself. Just take this week: we have gone NOWHERE. There have been plenty of annoying wiggles along the way, but honestly, the /ES chart speaks for itself. It’s like they might as well have come up with another bogus holiday, this time a week long, just to skip it.

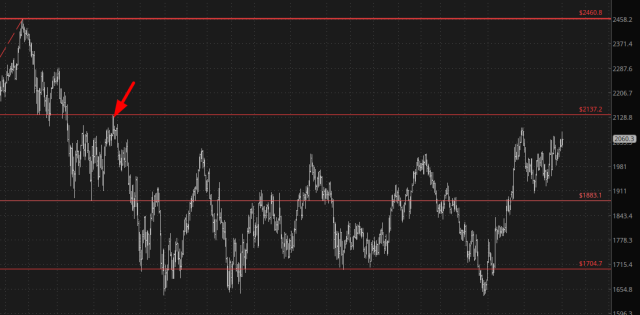

Looking longer term, at the /RTY, we’re still range-bound, and the Fibonacci I’ve emphasized with the arrow is the key for the bulls. If the market can break it, sentiment will go from 99.99% bulls to a solid 100%, as the completion of a two year base would send the market God-knows-how-high.

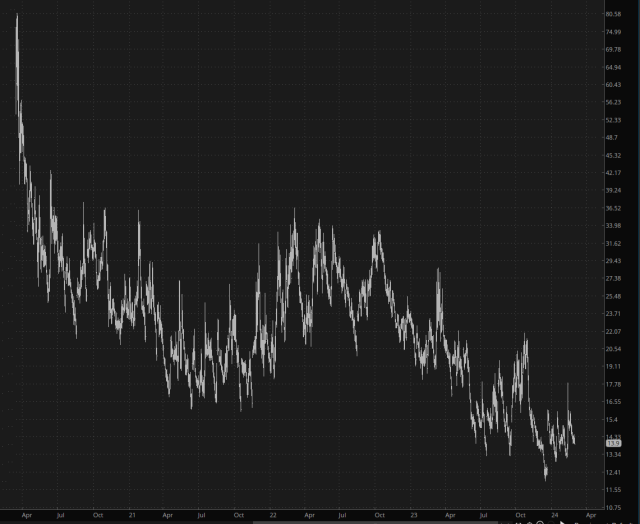

It has taken about four years for the market to simultaneously get smothered to death and also propelled to never-before-seen heights. The VIX has been absolutely massacred, as premiums have dropped to almost immeasurably-low levels as risks across all categories have, one would conclude, been successfully addressed. From the 80s to barely hanging on to the teens, the VIX is now a prepubescent wipeout.

Overall, I think Einstein said it best.