Among the wreckage of Tesla-wanna-be “new green deal” companies out there, each of which is a flaming dumpster fire of cow dung, one particularly bad one is Canoo (which has the oh-so-clever symbol of GOEV – like GO Electric Vehicle……..get it?) It has lost approximately 99.6% of its value, which is an abysmal performance by any standard.

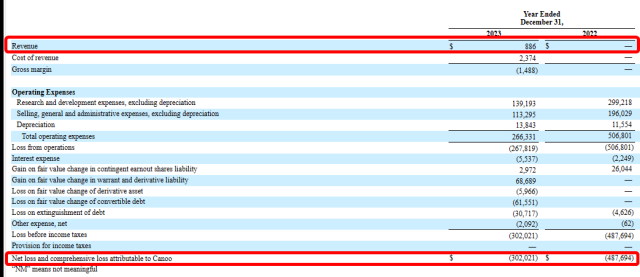

Now, I’m much more of a chartist than a fundamentals guy, but glancing at the financial data for Canoo is quite the study. Below, for example, we can see they turned in revenue for 2023 of $886,000. That figure isn’t in millions. They literally delivered 22 vehicles over the entire year. Twenty-two. Of course, that’s cause for celebration compared to their prior year, in which 0 vehicles and $0.00 in revenue were enjoyed. The literal bottom line to this is that they bled out $488 million in 2022 and $302 million in 2023. They lost nearly a billion bucks on not even a million in revenue. Incredible.

So, who’s in charge of this steaming pile of money-losing dog crap? Why, the chap below, Tony Aquila, who, judging from this photo has absolutely zero issues with his self-esteem, the aforementioned catastrophic data notwithstanding.

If one examines the lengthy 10-K submitted to the SEC for this organization (which would make you one of seven people on the planet who have done so) and looked way, way down on pages 121 and 131, you’d find a couple of choice nuggets. To wit:

In November 2020, Legacy Canoo entered into an agreement with Mr. Aquila (the “Aquila Agreement”), as may be amended from time to time, pursuant to which he serves as the Executive Chair of the Board. The term of the Aquila Agreement commenced on December 21, 2020 and will end on December 31, 2023, or, earlier, upon his voluntary resignation from our Board upon at least thirty days’ notice, his failure to be re-elected to the Board by our stockholders at the third annual stockholder meeting following the consummation of the Business Combination, or a vote of no-confidence by a majority of the Board. Mr. Aquila is paid a $500,000 annual fee in equal quarterly installments and is entitled to any benefits and perquisites generally available to members of our Board. He is reimbursed for business expenses, including air travel expenses for either, at our option, first class airfare or the business use of his private jet (at a fixed rate per hour, as set forth in the Aquila Agreement), executive housing on a tax grossed-up basis and business expenses associated with the office of the Executive Chair.

……..and……..

Mr. Aquila, through an entity owned and controlled by him (Aquila Family Ventures, LLC (“AFV”)), owns a personal aircraft that was acquired without our resources, which aircraft he uses for business travel. We reimburse Mr. Aquila for certain costs and third-party payments associated with the use of his personal aircraft for Company-related business travel, excluding certain incidental fees and expenses. We incurred approximately $1.7 million and $1.3 million for such reimbursements for the years ended December 31, 2023 and 2022, respectively. In addition, certain AFV staff provided the Company with shared services support in its Justin, Texas corporate office facility. For the years ended December 31, 2023 and 2022, the Company incurred approximately $1.7 million and $1.1 million, respectively, for these services.

So, to put that in simple terms: Canoo reimbursed $3 million to Mr. Aquila for the use of his own jet over the same two years in which the organization’s entire revenue was $886,000. In other words, the gross revenues from the entire company covered almost a full 30% of paying this guy back for the use of his own jet.

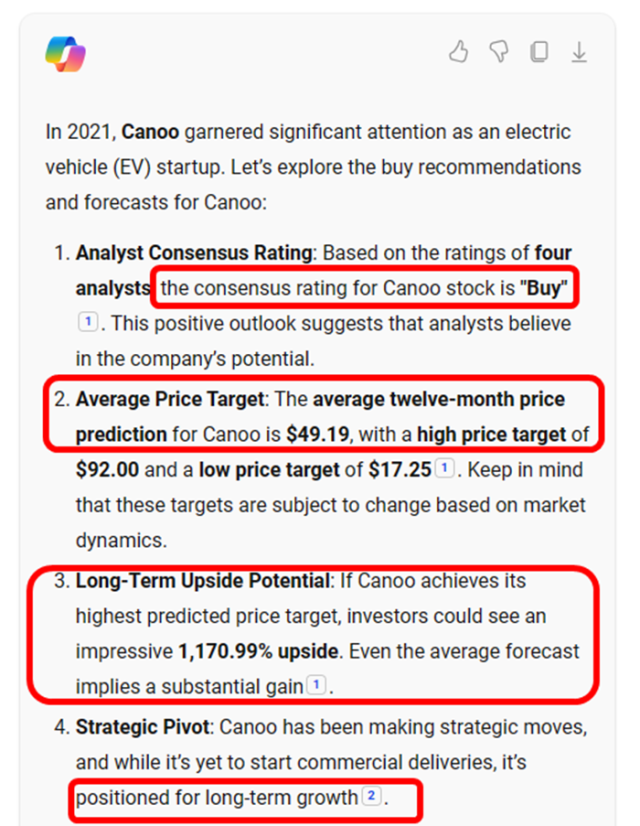

So, back in 2021, were analysts screaming blue murder about this piece of junk, warning investors to stay as far away as possible? Let’s find out!

Proving, once again, that Wall Street analysts are probably the only thing on the planet less valuable than Canoo itself. But at least Tony and his tattoos are traveling in style!