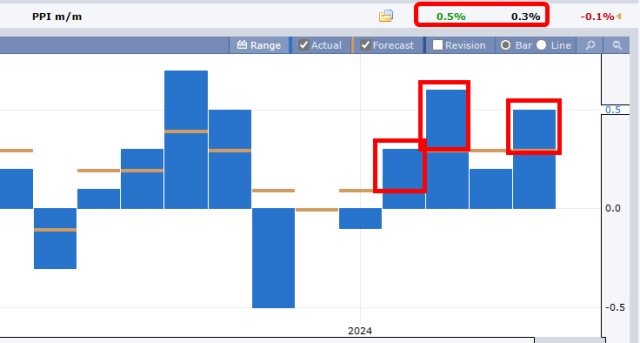

Let’s set aside GME and AMC lunacy for a moment and examine what was supposed to be the morning’s top event, which was the monthly release of the (totally watered-down and laughably low) Producer Price Index. The expectation was 0.2%, but the actual figure was 0.5%, which was 250% of the expected value. For 3 out of the past 4 months, the PPI was higher than expected.

The month-over-month change was expected to be 0.3% but came in at 0.5%, again, much hotter than expected. Again, for 3 out of the past 4 months, the month-over-month came in higher than expected.

Just a heads-up…………

So what did the /ES do? It plunged, of course! Because cooling inflation is supposed to be the MAIN reason that stocks are such a great bargain right now! And, appropriately, the /ES dropped by 30 points………….only to instantly recover it and go into the green.

Let’s put it this way: if the expectation for PPI was 0.5% and it came in at 0.2%, the /ES would have shot up 100 points AND STAYED THERE.

My hand to God, between the resurgence of the meme stocks, Dave Portnoy, and a market which goes UP on a day when inflation comes in incredibly hot, this market makes less sense to me every single day.