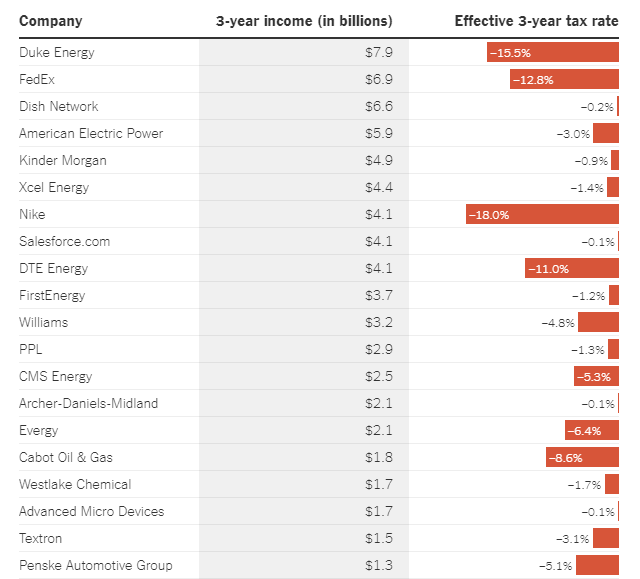

As you are paying your property taxes, sales taxes, federal income taxes, state income taxes, utility taxes, gas taxes, and God-knows-what-else taxes, here’s a fun thing to keep in mind: plenty of gargantuan corporations not only pay zero taxes, but they actually get REBATES from the government. This is the miracle of corporate lobbying in D.C., folks! Here’s a taste:

Food conglomerate Archer Daniels Midland enjoyed $438 million of U.S. pretax income last year and received a federal tax rebate of $164 million.

The delivery giant FedEx zeroed out its federal income tax on $1.2 billion of U.S. pretax income in 2020 and received a rebate of $230 million.

The shoe manufacturer Nike didn’t pay a dime of federal income tax on almost $2.9 billion of U.S. pretax income last year, instead enjoying a $109 million tax rebate.

The cable TV provider Dish Network paid no federal income taxes on $2.5 billion of U.S. income in 2020.

The software company Salesforce avoided all federal income taxes on $2.6 billion of U.S. income.

Or a different way to look at it…………….

Keep all this in mind when these businesses are squealing at the prospect of higher taxes, which I suppose will just mean their negative tax rates will be slightly less negative.