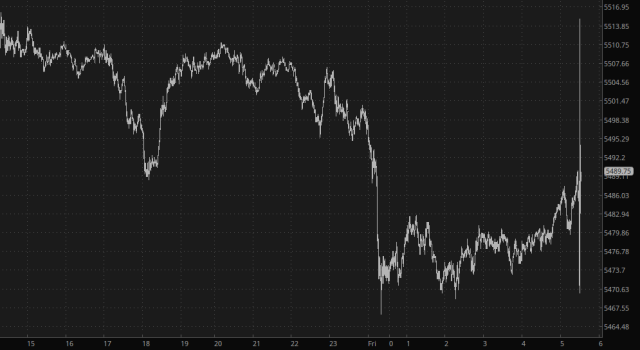

The jobs reports came out, and it wasn’t that big a divergence from predictions. The rate is at 4.2% still, although hourly wages are heating up a bit faster than thought, and new jobs were a bit weaker than thought. Overall, a “stagflation” type picture, although the immediate reaction has shaved off a bit of equity weakness. As I’m typing this, equities are down fractionally, but still just a touch red.

The longer term picture shows that the /ES has been very kind to the bears this week (for a change). I’m not sure how much of a recover the bulls count do today, My sense is that, yeah, we might be in the green at some point today, but the bulls are swimming upstream. I say that with the proviso that the /ES has pushed 35 points off its lows in the time I’ve been composing this little missive.

Bonds seem more sure of themselves. After an initial head fake, they are strengthening. It all goes with my philosophy these days. Bearish equities (yep). Bullish gold (yep; ;it’s up!). Bullish bonds (see below).

The bigger bond picture portends good fortune.

I’d like to close by making mention of PopTart (AKA MovinFwd), whom I know some here are quite fond of, based, it would seem logical to conclude, on his ostensible trading prowess.

I never knew him, except by way of a number of emails he sent to me over the years privately.

Years ago, he was a paying subscriber to the site, and I think it would be an appropriate act to remit the sum of those funds to a charitable organization (helping dogs, naturally!) which is what I’ve decided to do. My brain is more that of a chartist than a trader, and I recognize that his skills in the latter were evidently much better than mine, which is a point I’ll never argue.

I simply wanted to take a moment to note that he was an important presence to some here on Slope, and I am pleased to have been part of creating a forum where you all could meet, converse, and learn from one another.

Good luck out there today.