It was another good day! However, being a cautious chap, I raised cash (again!) in anticipation of the CPI result in the morning. The mere fact that I took some profits and bumped cash up to 29% probably creates a metaphysical guarantee and the market will absolutely plunge in the morning. We shall see.

In the meanwhile, resistance held beautifully. On the /ES, we have rallied mightily since the opening bell on Sunday, and we smashed right into the red line that formerly represented supporting price levels. The overhead supply in this region is an important barrier.

You can see the same thing play out with the /NQ, with a bit of a twist. Take note how, a couple of weeks back, the /NQ kept trying again and again to bust through that higher resistance level, and it failed to do so every single time. It then found support (green arrows) only to have a “phase change” make THAT lower line turn into resistance as well! And that’s where Tuesday’s silly rally put us.

This phase change can be seen with the /RTY (small caps) as well, and I’ve emphasized it with an oval. As with the /NQ, the /RTY tried to reach escape velocity, but it failed utterly. We actually hit resistance already on Friday, and even with today’s pointless rally, the /RTY couldn’t even muster a match of Friday. Indeed, it made a new intraday low for this cycle.

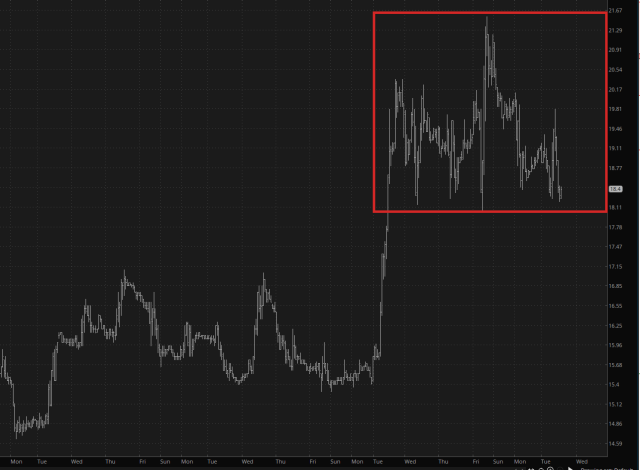

The next six trading days are going to be straight-up bonkers, and you can see the psychological distress reflect in the VIX’s spasms. It is banging between the high teens (“Don’t you worry your sweet little head; the government will always save us!“) and the low 20s (“Oh my GARD! Red Quotes! Aren’t those illegal?!?!”)

In summary, here’s my situation:

Big Account

- 29% cash

- 10 long put positions (expiring no earlier than late January 2025)

- +12.2% average profit

Small Account

- 7% cash

- 8 long put positions (expiring no earlier than late January 2025)

- +11.9% average profit