Yesterday’s scheduled news was the CPI, and this morning we got the PPI (Producer Price Index). As with yesterday, it came in hotter than expected, dashing hopes on any bold rate cuts next Wednesday. Of course, considering what happened yesterday, one has to wonder if any of this matters, but more on that in a moment.

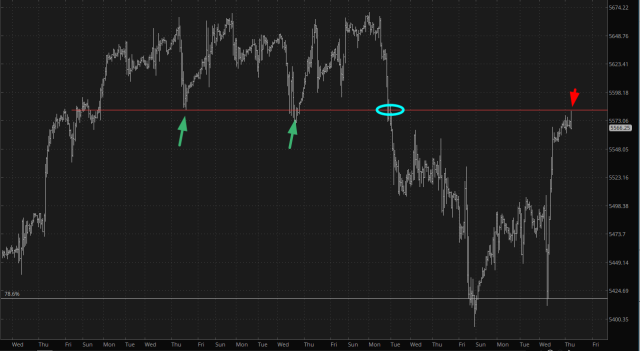

Yesterday’s four hour rally undid an entire week’s worth of damage (or progress, depending on which side you’re on). Still, the levels which formerly constituted support now represented resistance, and for the moment, I am certainly relieved to see the dam still holding back the water. Here is my perception of the /ES action in recent weeks:

The same formation plays out with the /NQ.

Yesterday’s mega-rally can certainly rattle one’s self-confidence, although I’m trying to remind myself that I’ve been doing a pretty good job staying on top of things in both directions.

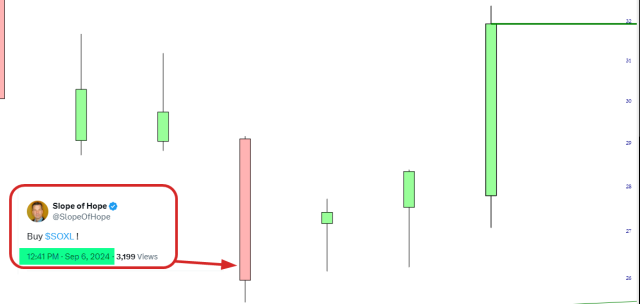

Late last Friday, when the market was in a total free-fall, I tweeted out something I pretty much never do, which is a simple two-word message to buy the aggressively bullish SOXL (semiconductor) fund. I got plenty of blowback for it, but, yeah, it worked out. The trade never took on any heat, and Wednesday was the kicker.

Even so, I am mightily annoyed that one man uttered a few words and added literally trillions of dollars to worldwide equity markets in the span of four hours.

When Jensen Huang, the CEO of Nvidia, said that demand for the chips his companies makes is strong – – were peopled shocked? What did they expect? For him to say that he’s really worried about the future and he’s not sure that AI use cases are going to justify the insane investment his customers are making? It’s bizarre.

Still, the self-promotion boosted NVDA enough to give him good prices to dump more of his stock (which he has been actively doing this summer) and to autograph the blouses of any comely lass who’s interested.