We saw SPX made the fifth straight doji or near-doji close yesterday, and all five of the last daily closes have been in the 1938 to 1941 range, which is a rare thing to see. How rare? I’ve had a look back and not as rare as I was expecting. I’m considering these as being a minimum three days tight range consolidation on the daily chart, with a minimum of three doji or near-doji closes in that period. There are sixteen instances from the start of 2009 and they break down as follows

9x – Modest retracement then into new highs

3x – Modest spike then full retrace back into doji area, then new highs

2x – Bear trend rally high

1x – Significant high

1x – Continuation

I’ve been looking for a modest retracement here before a move to new highs, and 75% of these previous examples saw a move down from the consolidation area. 75% of those then went to new highs and the other 25% went much deeper. Of the remainder three made a modest thrust up that was then fully retraced, before going to new highs, and just one of the sixteen continued straight up.

This makes sense as there is a price and time trade-off in consolidations/retracements and these five doji closes have been a retracement in time rather than price. It makes sense that any break down after would be the shorter for that. The odds are 75% for this resolving downwards and then 75% that we see a modest retracement followed by new highs, and 25% that a larger retracement has begun, though I’d note that two of the three significant highs made were rally highs in a bear trend, which isn’t the case here of course.

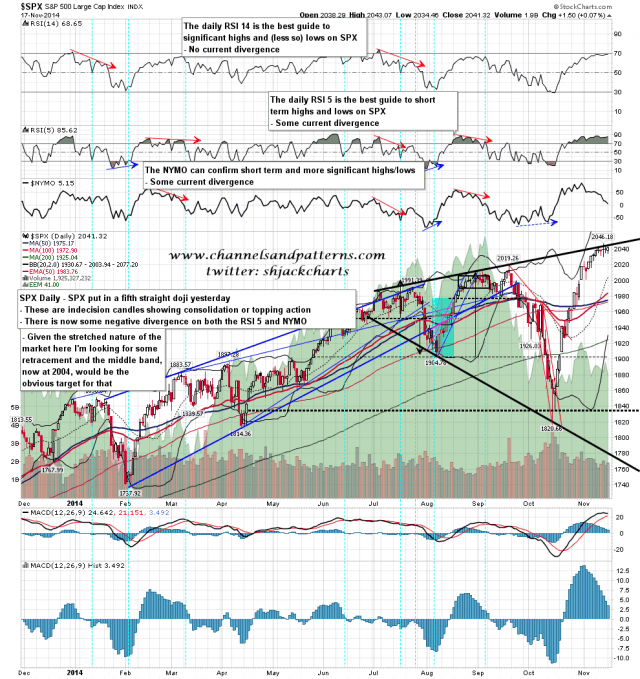

On the daily chart resistance is holding and the obvious target for a modest retracement would be the daily middle band, now at 2004 and rising rapidly. SPX daily chart:

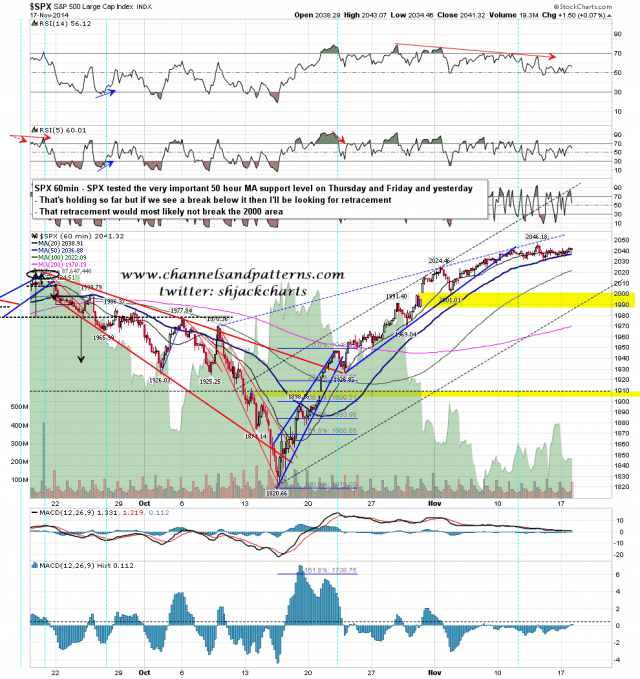

Short term strong support is still at the 50 hour MA, now at 2034 SPX. SPX 60min chart:

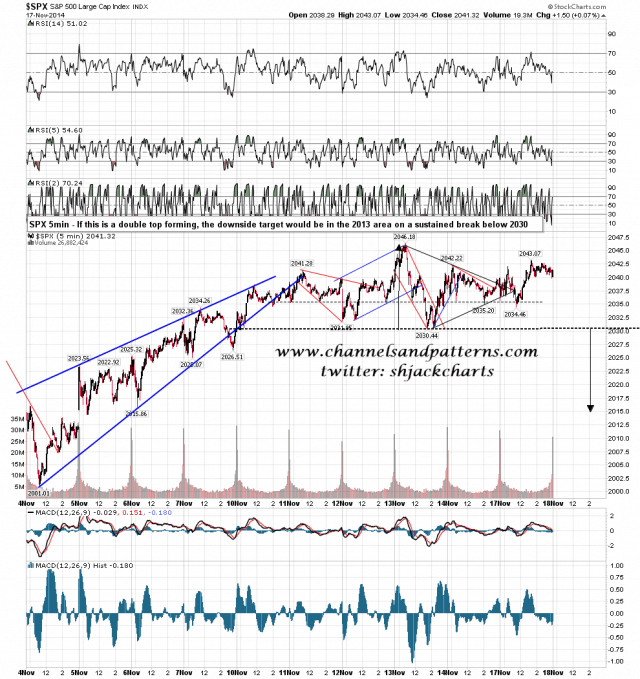

If this retracement ever starts, then the first sign would be a break of the 50 hour MA, and then next should be a break of possible double top support at 2030. On a sustained break below that the double top target would be 2015. SPX 5min chart:

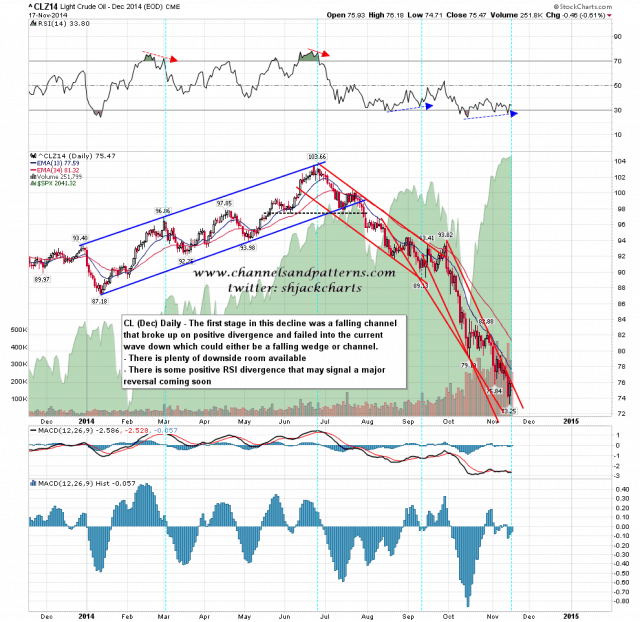

The rally on CL is testing decent declining resistance. We may see another leg down on oil start here. CL daily chart:

I’m still expecting a modest retracement to start sometime soon, and then continuation upward after that. I am hoping that the wait won’t be as boring as most of the last week.