SPX failed to get back to 1990 by the January close, so I’m calling this year for the bears on my first three days of January stat. I outlined this setup on 7th January and you can see that post here. Of the six years in the last 43 years where this stat has fixed at the end of January the best two performers were up 3% and 1%, last year was marginally red, and the remaining three were down 10%, 11% and 39% (2008) respectively. The odds are against anything better than a flat close this year.

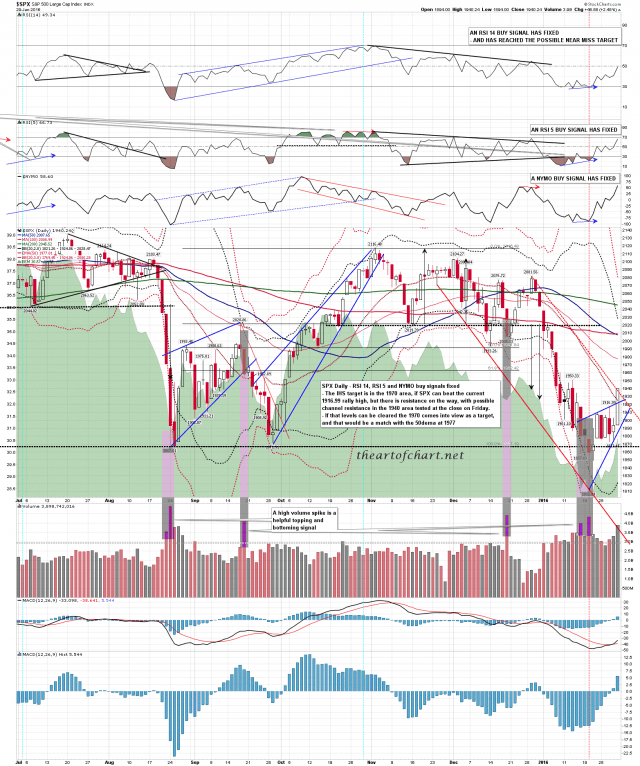

In the short term ES has broken up from an ascending triangle and I’m expecting broken resistance at 1912 ES (~1917/8 SPX) to be retested this morning. That might not happen as it has already been retested overnight, but we’ll see. The full triangle target is in the 2020 area, but these are bad at making target and Bulkowski recommends using a target at 61% of the full target. That would put this target in the 1978 area, which may well still be overambitious. ES Mar 60min chart:

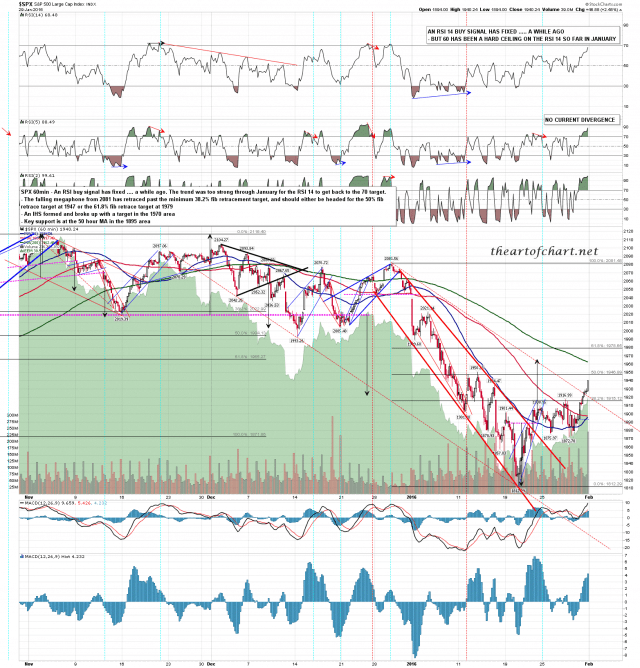

There is still a 60min buy signal that has not yet made the full target and I’m expecting that to be made. I like the IHS target at 1970 SPX as a target and that should be in the right range for a rally high this week. SPX 60min chart:

I posted a number of possible resistance areas on Friday morning and SPX closed at one of them, which was possible channel resistance at 1940. I’m not expecting that to hold but if we see a break back below 1910 SPX this morning I’d be wary of buying dips today. SPX daily chart:

Today is the first trading day of February and the historic stats are about 70% bullish. I’m expecting to see a green close today. This is just a counter-trend rally though, so if we see a hard break down that should be respected.