FOMC is the big wild card today of course and it seems fairly clear that the market isn’t expecting a rate rise for quite a while. I suspect that’s exactly right but that is the likely reality rather than the perception. From the Fed perspective they have at least demonstrated last year that they can remember how to raise rates, and the credibility from that tiny uptick then gives any barking they do now about the possibility of them biting again with another tiny rate rise at least some credibility. The guidance given before this meeting today suggests that Yellen will be talking tough today on possible interest rate rises coming and if she follows through on that guidance then there may be a negative market reaction at 2pm. We’ll see.

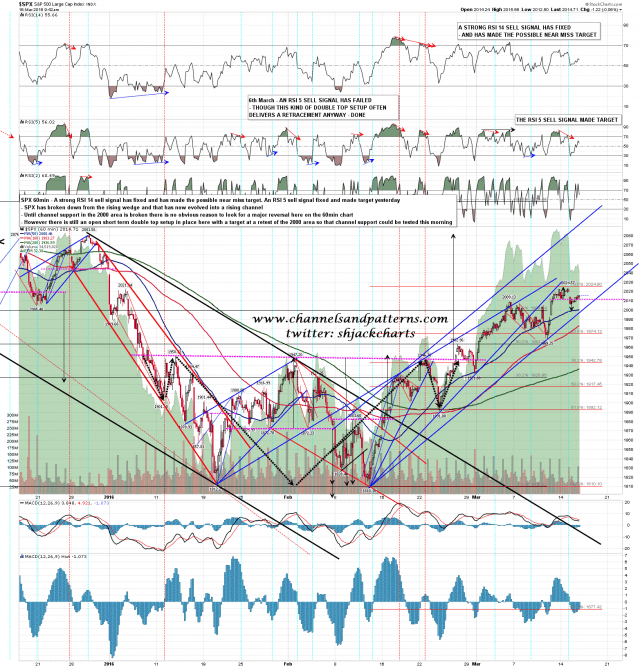

SPX didn’t make the obvious target at the 2000 retest yesterday and isn’t showing much sign so far of testing that today. Rising channel support closed yesterday at 2000 so unless that test is in the first 90 minutes today that test would then be below channel support. That said, the rising channel on RUT broke down yesterday and I’m not expecting the SPX rising channel to survive the end of this week. SPX 60min chart:

I’m still expecting at least a retest of the 2015 high on ES today but I am wondering about the setup on NQ below where the setup is looking like a possible rally high. We’ll see how that goes today. NQ Jun 60min chart:

My ideal day today would be a run up to new rally highs on ES and SPX this morning before a hard fail on FOMC that would then break the rising channel and set up a possible retest of the last short term swing low and possible H&S neckline at 1969. Will that happen? There’s only one way to find out for sure. 🙂