I caught the SPX on a longer term panel today and a few things immediately stood out to me. First up we are most definitely in a corrective phase, which is obvious simply by looking at the chart. No indicators or quant magic needed.

(more…)Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

I caught the SPX on a longer term panel today and a few things immediately stood out to me. First up we are most definitely in a corrective phase, which is obvious simply by looking at the chart. No indicators or quant magic needed.

(more…)

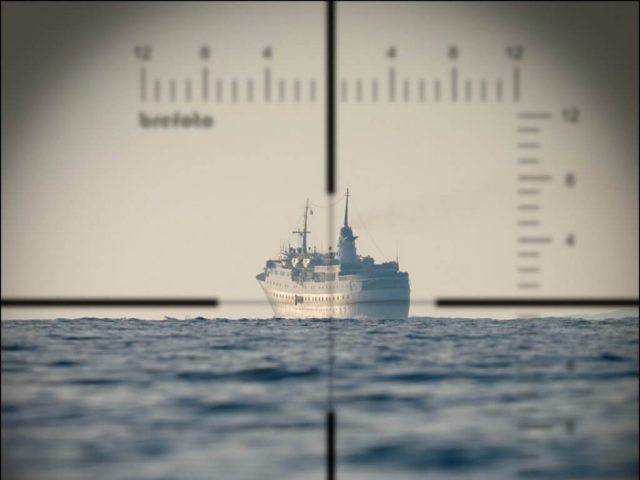

Ladies and leeches, this is your pilot speaking. Please fasten your seatbelts and return your tray table to its full upright and locked position. We are heading into a potentially explosive week during what has already been a rather explosive year. Be advised that in the unlikely event of a water landing, it’s every man and woman for themselves!

(more…)October starts with a bang and a legion of misinformed retail traders assume that we’re heading straight into the next bear market. Not impossible of course given what’s going on but even IF we’re heading that way on a medium to long term basis (still doubtful) we are still going to see a bounce preceding it. Here’s why and how to take advantage:

Recently I’ve talked a lot about implied volatility, mean reversion, linear regression, and other exotic topics. But there comes the time when you simply need to take a step back, clear your mind, and just look at the situation from a very straight-forward and practical perspective. So let’s channel our inner Steve Jobs (yup fan boy here – bite me) and look at some basic price charts:

(more…)