A Signal You’ll Find Nowhere Else

This market is marvelously exhausting. I’m already resenting the weekend ahead, since it’ll create a break in the festivities. Can you imagine if Juneteenth was coming up? The past three days feel like thirty, and the only sad thing is that – – as Colonel Kilgore assured us – – someday this war’s gonna end.

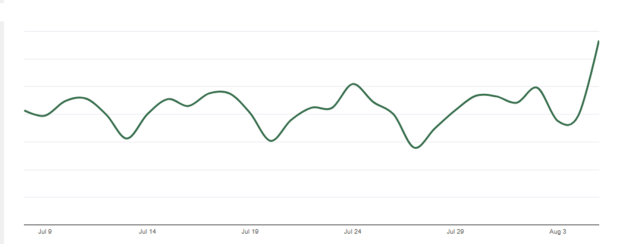

In the meantime, though, the bombs are dropping, and Slope’s 20 years have proved one thing: when the market gets battered, Slope gets popular. It’s only just beginning……….