So are you as excited about the Vice Presidential Debate tonight as I am? Yeah. That’s what I thought. Anyway, I thought we’d thumb through some charts together. Generally speaking, this seems to be the market that Cannot Sustain a Selloff. Every stinking day, you get an end-of-day ramp, and the market is “saved”. It’s unnatural, it’s sickening, and, as hard as it may be for you to believe, it can’t last forever.

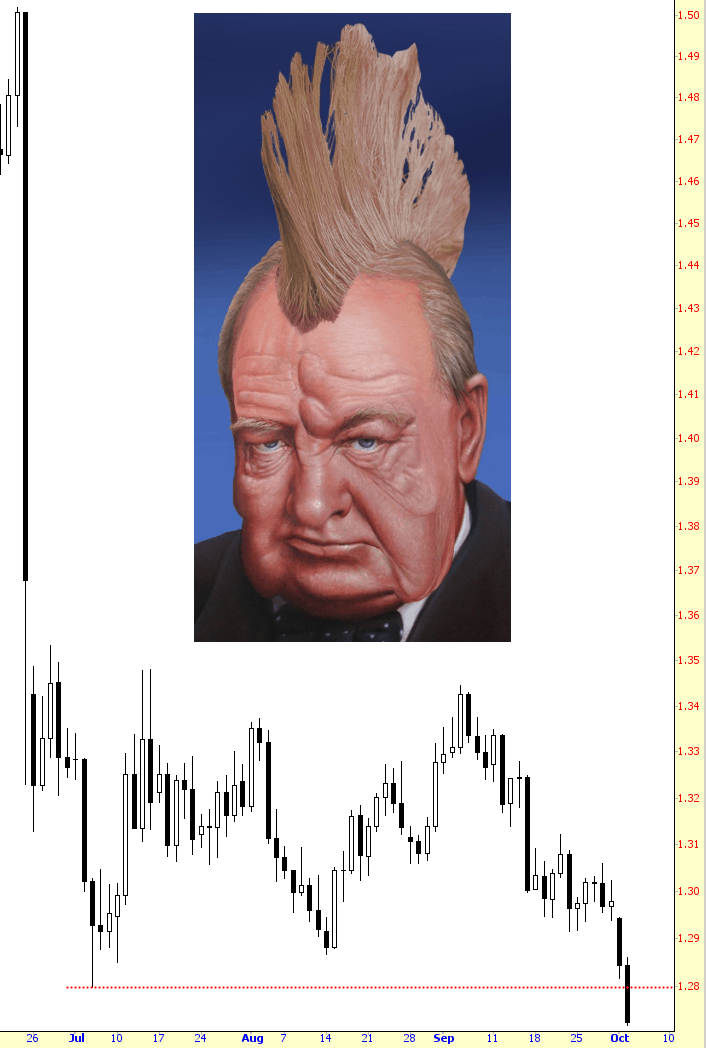

One market that doesn’t have a problem “staying sold” is the British Pound, which has fallen to a level not seen in decades. My advice? Go to London and buy stuff, I guess! Your dollar is strong!

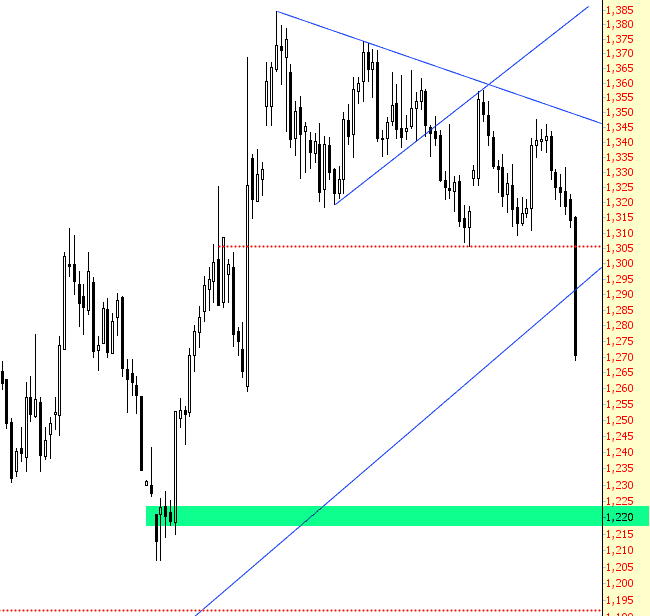

Another market that, unlike equities, has no saviors to come rescue it, is precious metals. They got absolutely massacred today (miners particularly – -my God, DUST was up 30% today alone!) As I mentioned earlier, I clued in my beloved Slope Plus readers to this possibility back on September 7th. Anyway, shield your eyes – – here’s gold – – with a potential target tinted in green.

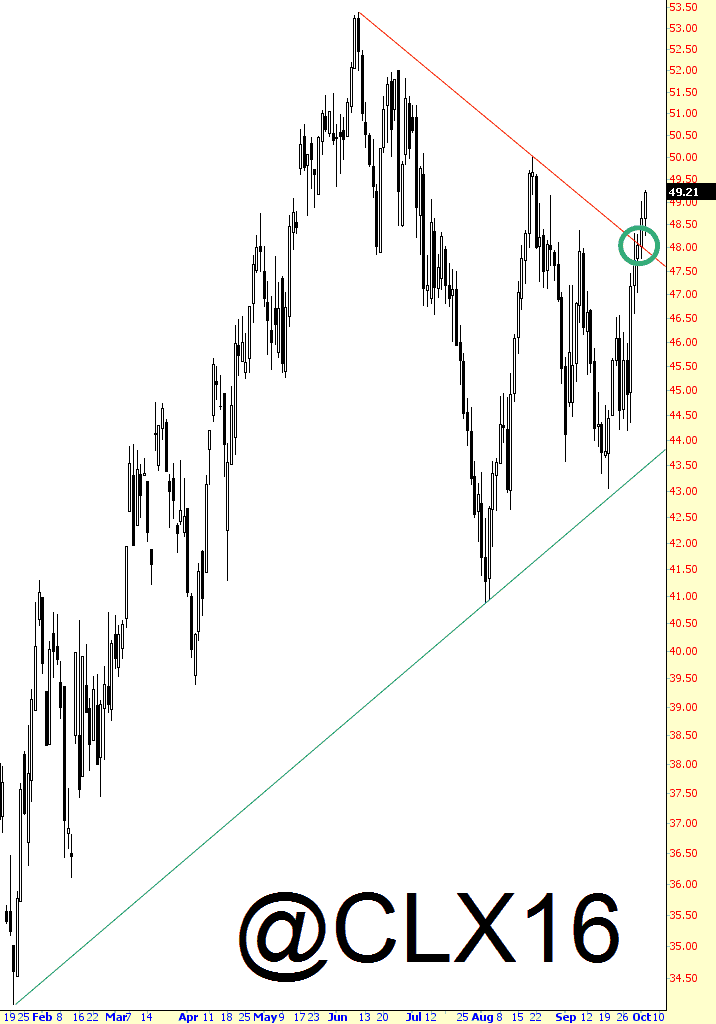

While gold is breaking down, crude is spiking up. It crossed its trendline a few days ago (circled below) and has been strengthening ever since. A cartel can do wonders, it seems.

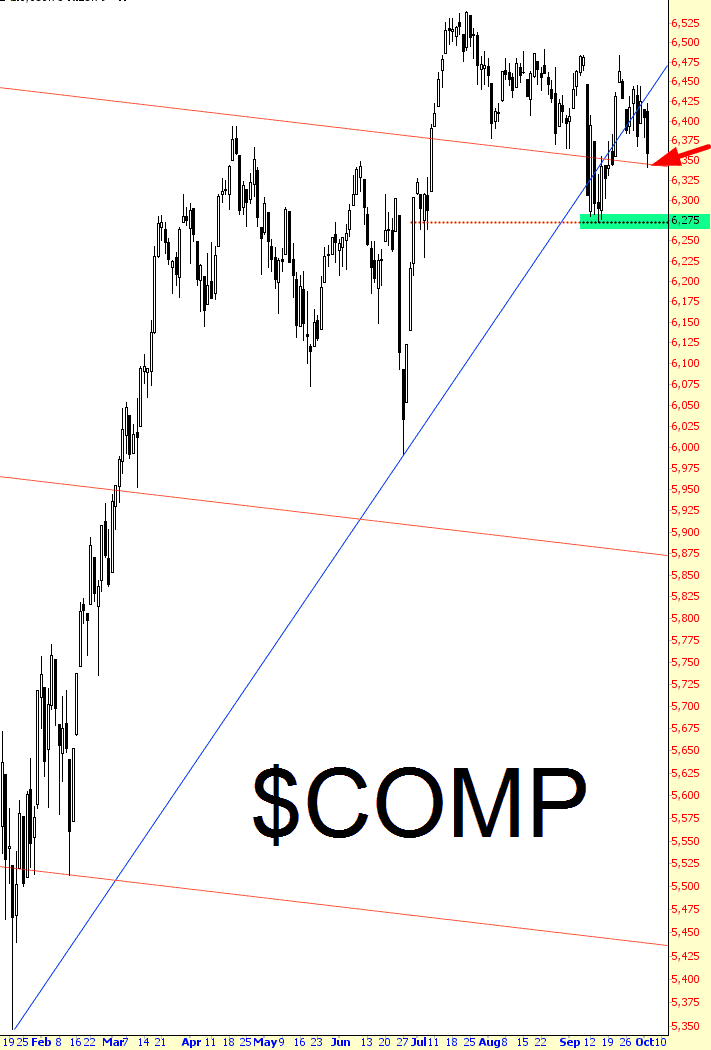

Now let’s focus on equities: the Dow Composite has already broken its ascending trendline. For the moment, it has found support (see arrow) at a trendline. It needs to break this low and break the tinted area in order to really get things cooking on the bear side.

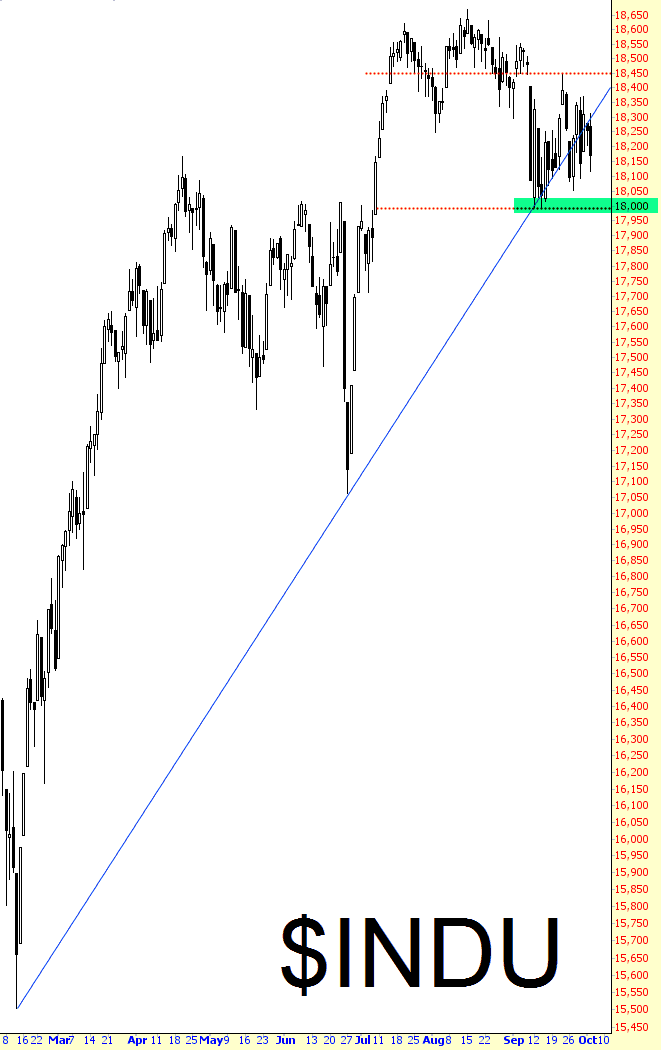

The Dow 30 is in a similar circumstance. It has already broken the trendline anchored to this year’s low, but we can’t get excited about any weakness until and unless we break 18,000. “They” just have to allow it to happen.

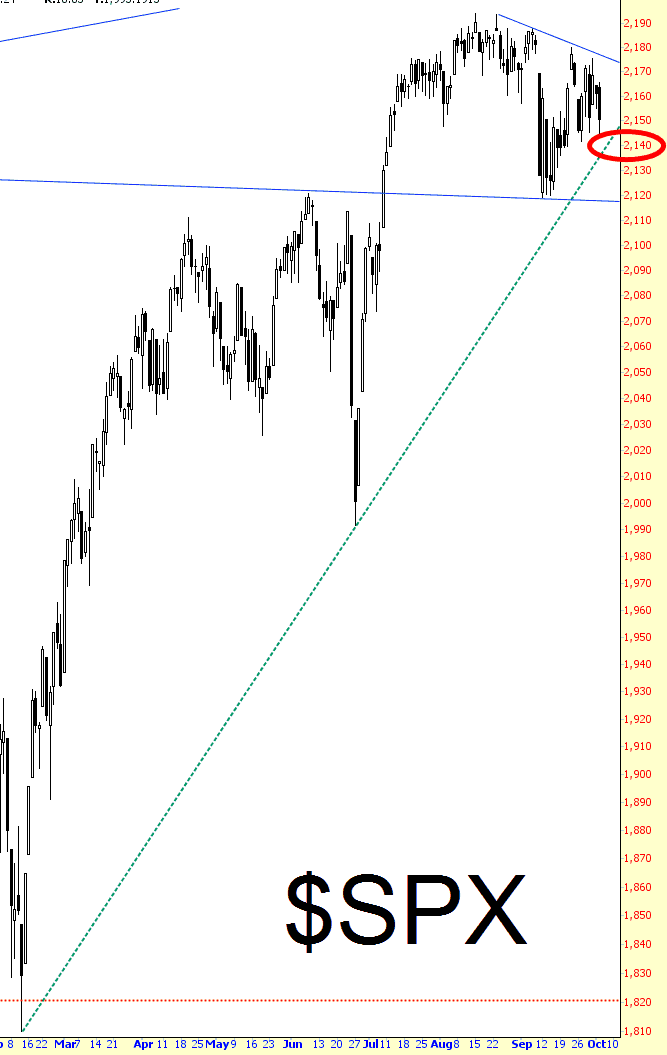

Lastly is the S&P 500. We need to break 2140. If we can muster that, the next goal is to break September’s lows. If we can manage that, well, maybe we’ll get a cataclysmic one or two day bear market! I can still dream, can’t I?