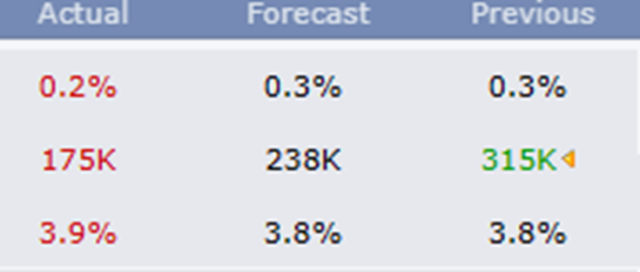

The unemployment numbers just came out, and it was another gift for the bulls: weakness. The job growth was much weaker than expected, and the unemployment rate is creeping up. The logic here, of course, is that this lameness will provide political cover for Powell to issue a cut in interest rates to provide a boost to the current administration. Market historians will acknowledge that every major recession kicks off with the Fed cutting rates, because they need to do that in order to goose the economy. It doesn’t matter now, though, because the markets are raging on the news.

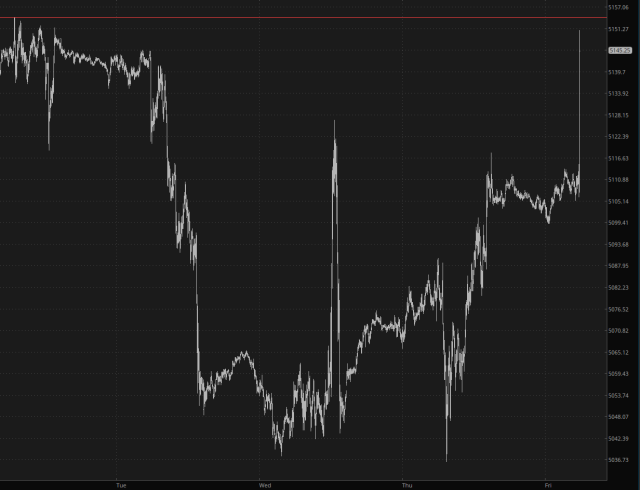

We see here bonds celebrating, as interest rates are slipping lower on the news.

In turn, equities are blasting higher. As I’m typing these words, the /ES is up 1.15%, the /NQ up 1.61%, and the /RTY up almost 2%.

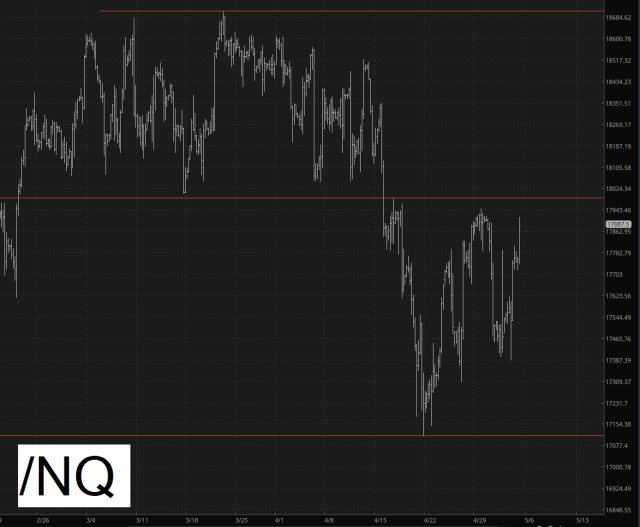

It might be wise to use a little thing called Perspective. Let’s back away from the tick by tick information and look at the longer picture for bonds, which is an absolutely picture-perfect right triangle top on the bonds. It makes total sense that we are rallying, because that has fallen so far beneath the pattern. Let’s just say once it reaches that red line again, you can see a big change.

I would say the exact same thing for equities.

Prospects for weakness in the future is cold comfort for any bears out there, however, since today is in all likelihood going to absolutely suck out loud for them and be another bonanza for the bulls.