I’d like to start with a comment I read; I’ve boldfaced the most germane bits……….

The AI buildout reminds me a lot of the late 90s and early 00s when there was a race to build out large telecommunications networks to provide the bandwidth to support all of the new activity that would take place on the rapidly rising technology.

Companies like Cisco and Lucent went parabolic as a large number of embedded providers (AT&T, Verizon, Comcast, etc) and new entrants (Qwest, Level 3, Global Crossings, etc) received large amounts of capital to build out new IP networks.

The problem was that the investment in network infrastructure greatly outpaced people’s ability to monetize it. It took nearly two decades to absorb the network capacity glut and there were only a couple winners when it was all said and done, with a ton of companies absorbed and destroyed in its wake. Cisco still hasn’t reached its all time high over two decades later and Lucent and other equipment providers lost a ton of value and were absorbed as demand for their products declined sharply. And the winners of the internet buildout were not the companies being touted during the dotcom bubble.

I feel like we’re in the early stages of a similar cycle. NVDA is like the telco equipment providers with the added benefit of not having any real competition and there are so many companies rapidly deploying their chips to make sure they get in on the AI game. I think NVDA will continue to soar until the buildout is complete. Large companies like Microsoft, Google, and Apple are racing to build capacity just like the telecommunications service providers back in the day and there are a bunch of new entrants fighting for mindshare. Unfortunately, no one has really figured out how to monetize the technology yet.

My prediction is that the AI trade over the next two years will looks like the culmination of the telecommunications bubble. Huge ramp over the next two years as companies race to build out capabilities, followed by a rapid decline as companies fail to figure out how to monetize the investment. NVDA will stick around but after it reaches its ATH it will struggle like Cisco did after the capacity glut is reached and the folks that actually figure out how to monetize AI will be different than a lot of the companies that are being bet on now.

Now I’m not so sure I agree that we are at the “beginning” of this and that there are “two years” left, but I agree with the general concept.

Years ago, I wrote a post on Slope called The Curse of Abundance, I learned a few things about how a lot (relatively speaking) of money, and I penned the following; here, again, I’ve boldfaced some key bits:

Allow me to share with you a couple of lessons I learned from having a bunch of money dumped in my lap. The first lesson is this: if you have money to spend, you will have absolutely no trouble at all finding parties that are happy to accept it in return for goods and services. The line will stretch a mile long with vendors eager to relieve you of all that heavy cash that’s making your legs go numb. A PR firm at $15,000 per month? No problem. A new database server for $40,000? Absolutely, right this way. A programmer who gets $100 per hour to write code on the cool new Palm mobile device? Yes indeed. They’re all ready for you.

The second lesson is: once you get used to spending money, it’s really, really hard to stop. In short order, I had all kinds of recurring expenses I didn’t have before. Whereas beforehand I had been extremely frugal, now I had become profligate. It’s a kick to write checks left and right. You get all kinds of shiny new stuff, and vendors have this funny habit of being really nice to you. It’s cool while it lasts.

But it doesn’t last. $1.6 million sounds like a lot, but it actually didn’t take that long before it had dwindled down to pretty much nothing. And, surprise, surprise, the ongoing expenses were still there. Paradoxically, getting all that money just about killed us. This blessing had become a curse, because I changed my habits the moment it became easy to do so. Sort of like those lottery winners you read about who go broke in a couple of years.

So why am I bringing all this up? Because of what I’m seeing all around me.

I am a fairly close witness to a lot of brain-buying going on right now. If you:

- are male;

- are in your 20s;

- went to a highly-esteemed school;

- have a computer science background;

- specialize in machine learning/AI

………….then you can write your freakin’ ticket. You can be a 22 year old making high six figures. Maybe even seven figures. You can get paid what a partner at a law firm gets paid. The world is your oyster.

Insanely-well-funded companies like OpenAI are absolutely drenching brilliant young men with cash to come to Them instead of going to The Other Guys. I have been witness, time and again, to situations in which a lad was going to get paid a huge sum at company A, and they mention, “Company B wants me too” prompting company A to say, “We’ll DOUBLE our offer.” It’s not a negotiation. It’s an offer they simply can’t refuse.

I’m old-fashioned, I realize, but at some point, a company’s revenues have to exceed its expenses. You cannot make hundreds of young men millionaires while trying to get consumers to pay a few bucks a month to dick around with ChatGPT. Added to which, I can assure you with a high degree of confidence that a great number of these aforementioned super-well-paid young men are just screwing around at work and laughing all the way to the bank.

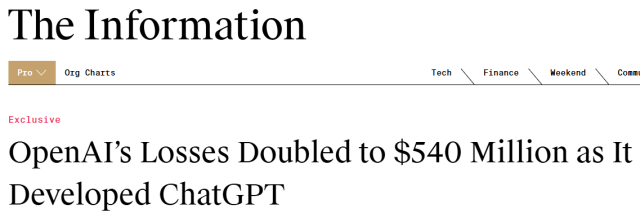

Of course, you’ve got breathless media reports stating how great OpenAI is doing. Revenues doubled! Yay!

While at the same time…………

Actually, that understates the case, because the “loss” article was from a year ago, when OpenAI expenses were vastly, vastly lower than they are today. I’m highly confident they’ll be bleeding billions for years to come.

I don’t think OpenAI will “Fail” as in “Disappear”, but I don’t think it’ll ever be a viable business unit. Sam Altman, and OpenAI, happen to be at the right place at the right time with the right fad, and once the vapors wear off, I think they’ll be pointing the seven-figure 20-somethings toward the Exit door, which will lead, I suspect, to more modest job opportunities.

As it is now, though, they’re gettin’ while the gettin’s good.