The earnings season is going to kick off with AA next week and I am so excited as it moves the market!

Earnings Play Examples

There are many ways to play with the earnings with the options and I hope I could cover them all some day. Here are some earnings play examples:

1. Take the delta neutral straddle/strangle positions a couple of weeks BEFORE the earnings, and take them off right before the earning release in order to take advantage of IV (Implied Volatility) rush.

(Note: IV rush occurs toward the earnings release when many traders speculate the underlying stocks which in turn pump up the option premium. Same theory that you might have to pay an extra premium to get the flood insurance right before the hurricane season).

2. Take the delta neutral calendar positions RIGHT BEFORE the earnings release to take advantage of IV crush.

(Note: IV crush occurs after the earnings release. Same theory that the insurance premium drops after the hurricane is gone).

3. Take a directional trade before the earnings release and hold on to the position afterwards for an instant gratification of the profits. This is the most riskiest strategy of them all, and a lot of retail traders lose money on the earnings because of this. Unless you know how to pick the direction and understand IV pump and dump, you will be most likely losing money on the earnings play.

4. You take the trade AFTER the earnings release. The results of the earnings would often times accelerate to the direction of the earnings. You would have a better sense of direction and a better risk/reward.

I have discussed the first 3 examples previously, but I have never discussed how to approach the "after earnings" play, so I am going to cover this topic this week.

Why "After Earnings" Play?

If you are playing with "Before Earnings" play as discussed in item 3 above, you are really going for a gap up/down of the earnings results, which accounts for a very small portion of the entire price movements and it's not worth risking your capital.

AA Last Earnings

If you take a look at AA's last earnings, you can see a "gap" as such a small portion of the entire price move.

BIDU Earnings Price Move

You can take the trade AFTER the earnings and still make a pretty good money. If you take a look at BIDU's last two earnings, you can see that the price movements of the big volume candle tends to repeat.

BIDU Daily

By the way, here is the BIDU daily that I discussed a couple of weeks ago. BIDU is right below the big wick candle as of last Friday and if it breaks above it, there is a very good probability of another $70 move.

AA Daily

Here is AA's daily chart. AA is forming a very nice H&S pattern and I'm almost certain that AA will drop upon the earning release. HOWEVER, unless you know how to play with the earnings, you would be better off waiting for the earnings release and then take the position. Much better risk/reward and no surprises. Of course, if you are looking for some excitement, you can take the trade beforehand at your own risk.

Metal Updates

My metal trades are going quite well. Here are some updates from last week's post.

GOLD

Silver Daily

GDX Daily

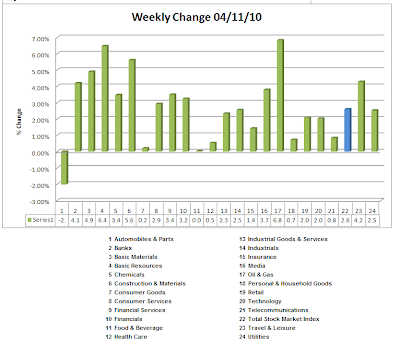

General Market Updates

I guess everybody now is watching 1200 area for SPX. I would just stay away from the major indices – it's too high to go long, but too risky to go short (it just won't drop!).

Here is the Q's weekly chart update that I posted last month. Qs now closed above the previous swing high, which is almost guaranteed to reach the next swing high before the consolidation.

AMZN Daily

AMZN has been lagging behind the general market but it finally started picking up.

Have a safe trip and hurry back home, Tim! I am going to hold the market for you until you come back!