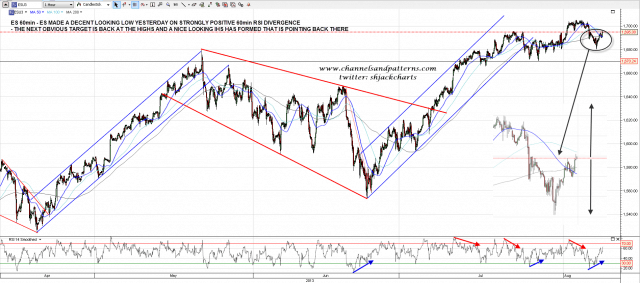

The double-bottom I was looking at yesterday morning on the ES 60min chart failed, just above the trigger level which is where these patterns generally fail when they do, but the 60min RSI positive divergence I was looking at increased into the low just above 1680 and we have seen a very strong bounce from there. The obvious target is back at a retest of the highs, and an IHS has formed that targets new highs. ES 60min chart:

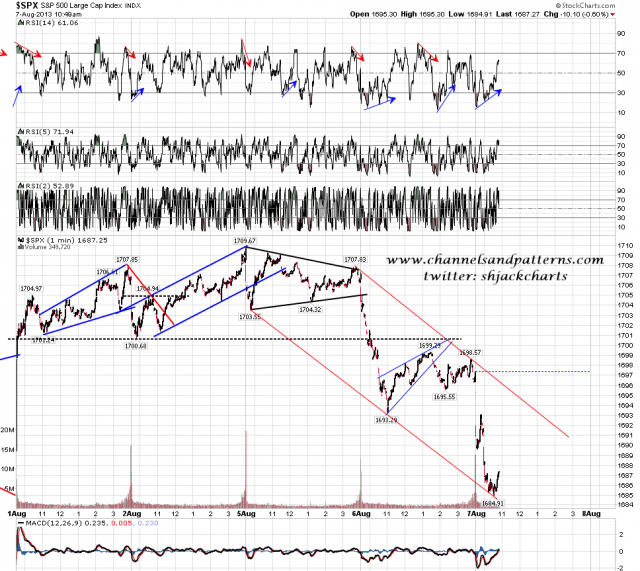

I called the low well with an SPX 1min chart on twitter. I post these regularly and they are worth looking at also to see that the same setups that I usually post on the 60min or daily charts are also very clearly visible on the 1min charts. SPX 1min chart:

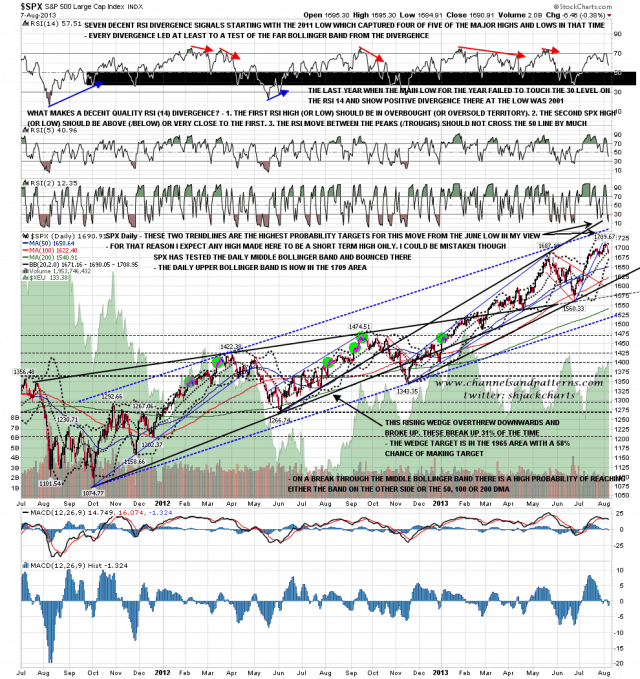

On the SPX daily chart the low was a test of the daily middle bollinger band, which is an obvious support area. The daily bollinger bands are pinching hard and I’m expecting a big move soon. Meanwhile daily upper bollinger band resistance is now in the 1709 area. SPX daily chart:

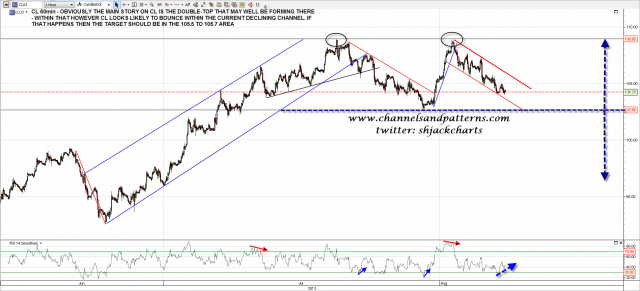

On other markets the bigger picture on CL is obviously the double-top that may be forming there. Shorter term we could see a bounce within the current declining channel into the 105.5 area. CL 60min chart:

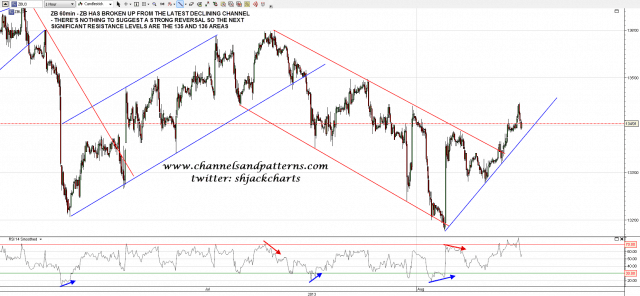

30 yr Treasury futures have now broken up from the declining channel I posted a couple of days ago. There’s no immediate sign of reversal and the obvious targets and resistance levels above are are 135 and 136. ZB 60min chart:

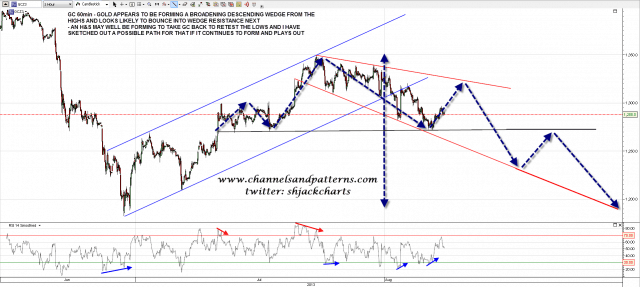

Gold futures have been forming a broadening descending wedge from the high and the next obvious move is a bounce into wedge resistance in the 1320 area. On the bigger picture an H&S may well be forming for a retest of the lows and I have sketched out a possible path for that. GC 60min chart:

ES is now back over the 50 hour MA (1690.5 area) and the initiative is back with the bulls. The IHS that has formed on ES is suggesting a test of the highs soon. As long as ES holds over the 50 hour MA on an hourly close basis I’m leaning bullish. If we see a break below 1689.5 then the IHS will be severely weakened and we might see another leg down to test primary support at 1670.5.