Here’s a quick real-time example to answer those which want to live and die by “numbers” alone. Where extrapolation of the numbers are de facto as proof of why something (marketing plan, business investment, fill in the blank) should proceed. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Bad Headline of the Day

Gold Above $1,400 on Syria Concerns, Taper Debate

It never ceases; the stupid reasoning they assign to gold’s price movements. Any gold bug pumping you about global political strife and gold is to be tuned out immediately. Any gold bug pumping you about anything even remotely religious is to be tuned out immediately. Any gold bug pumping you about Indian wedding season is to be tuned out immediately. Any gold bug pumping you about gold and this utterly over done ‘taper’ debate crap is to be tuned out immediately. (more…)

Syriasly?

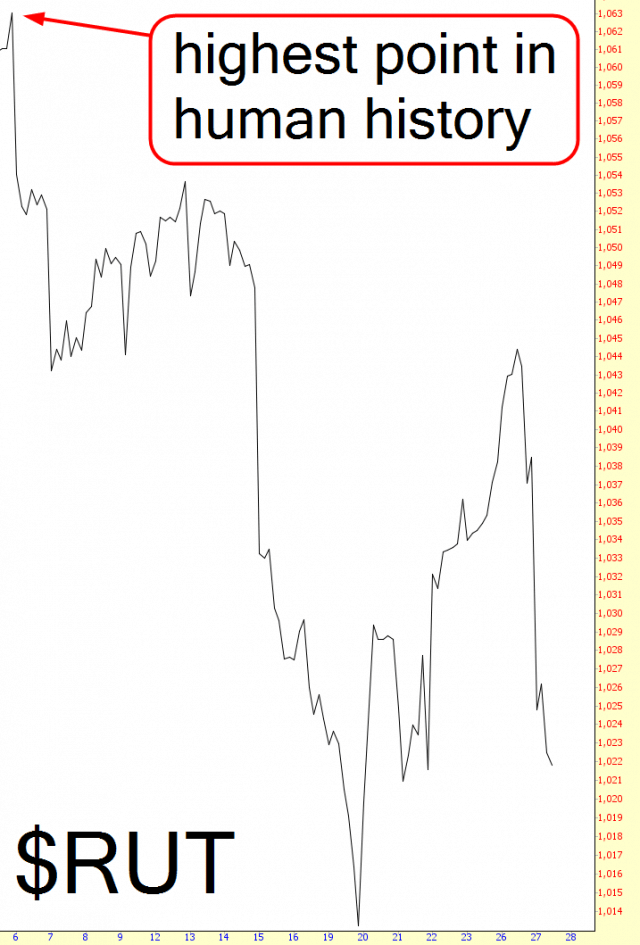

It’s pretty sad that it takes poison-gassing of children to make the market come to its senses. It’ll take years before things grind down to their true values, with all the artificial props holding it up. The down-market is a start, but it sure would be nice if war wasn’t required to stop the bulltards.

Aussie Banks in for a Rocky Time

The banks that escaped balance sheet damage from the 2008 financial crisis are those down under in Australia.

Previous posts:

Australia to enter a very sad decade – Update2

Australia to enter a very sad decade – Update

Australia to enter a very sad period

The Aussie banks and economy was saved by the 18% of GDP stimulus China started on the eve of the crisis. This allowed Aussie exports to flow to China without a any major hick up, this also allowed the Aussie property market to avoid any serious down swing. (more…)

Declining Channels Abound

I posted on twitter last night that my rally into the 1670s scenario might well be trashed if ES broke below 1650.75. ES did and that scenario is a write-off. ES double-topped yesterday with a target at 1650 and a declining channel has now been established with channel support in the 1620 area today. There is some positive RSI divergence here and we could see a bounce. I don’t yet have a pattern for the decline from yesterday’s high. ES 60min chart: (more…)