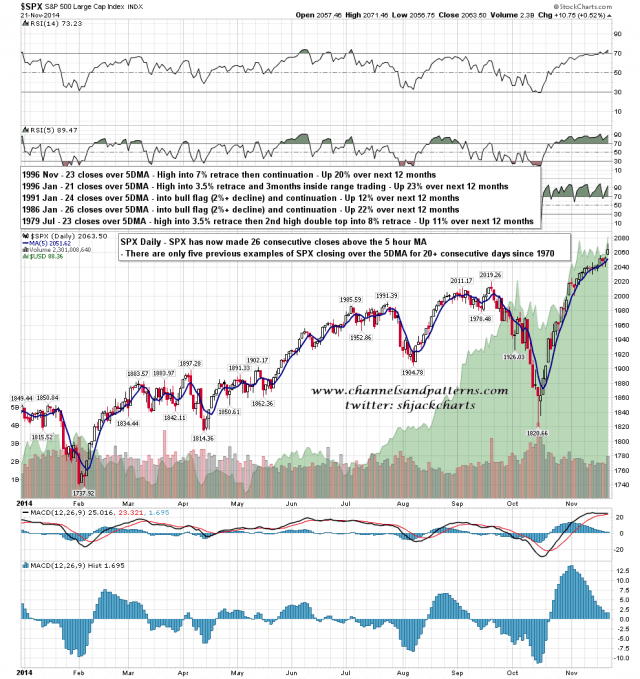

I’ve done more work on the daily closes over the 5 DMA stats this morning and taken these back to 1970, during which time there have been only five previous examples. On Friday SPX closed above this for the 26th consecutive day and matched the longest previous example during this period which was in 1986. As and when we see SPX close back below the 5 DMA we can expect a minimum 2%+ retracement there but otherwise the historical stats were not at all bearish and I will be talking about these more tomorrow. Meanwhile the stats are on the chart below. SPX daily 5 DMA chart:

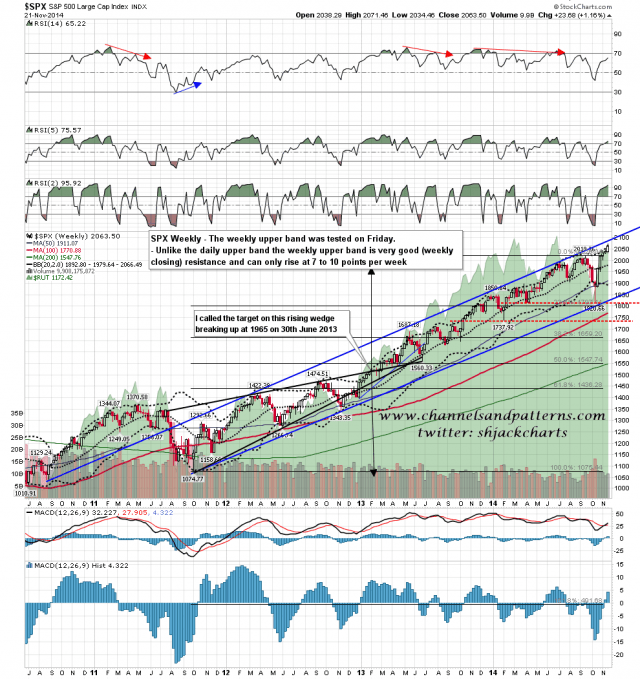

SPX hit the weekly upper band on Friday. This can only rise at 7 – 10 points per week and tends to be very strong resistance on a weekly closing basis. This is likely to limit upside over the next few weeks though SPX may well ride the band upwards. It just isn’t likely to be that fast. SPX weekly chart:

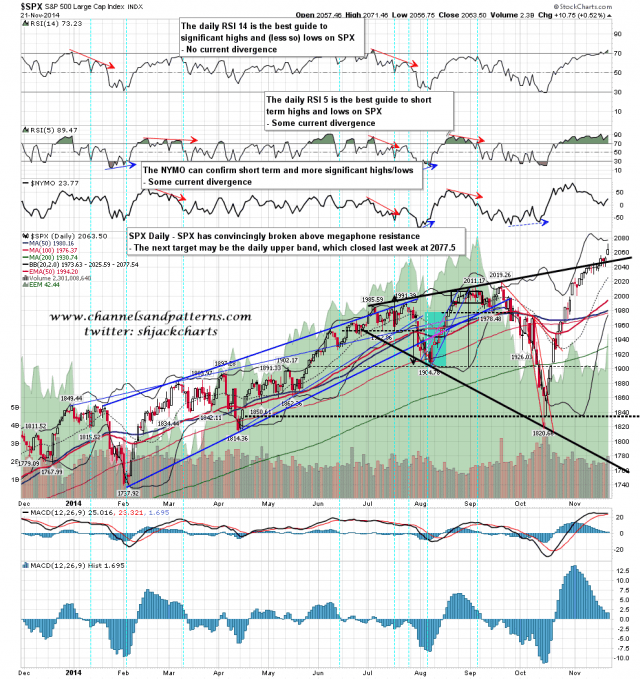

If we see more upside today the daily upper band is at 2077 and that is an obvious target. Given that it is 11 points above the weekly upper band close on Friday, that would be a nice looking short entry. SPX daily chart:

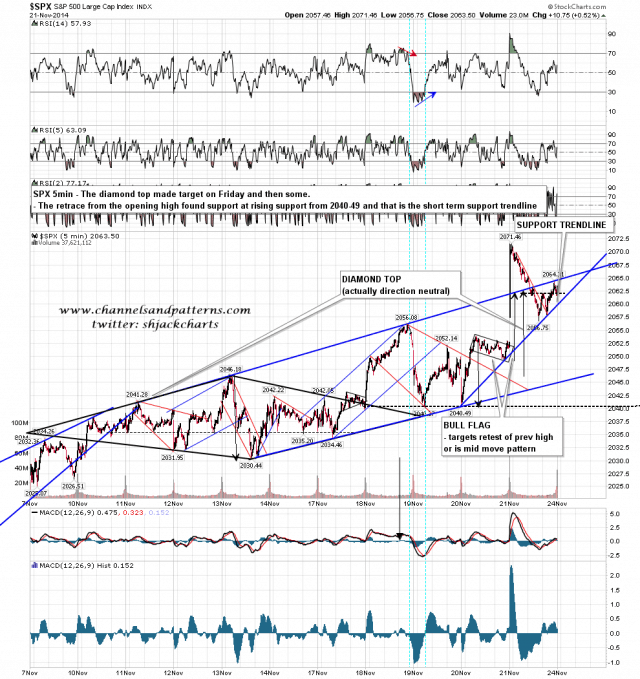

The low on Friday was at rising support from 2040 and that is short term support today. that was in the 2060 area at the close on Friday. SPX 5min chart:

We may well see a retest of Friday’s high today. If so then I’d expect decent resistance in the 1970-80 area and a likely move back to at least test Friday’s low afterwards.