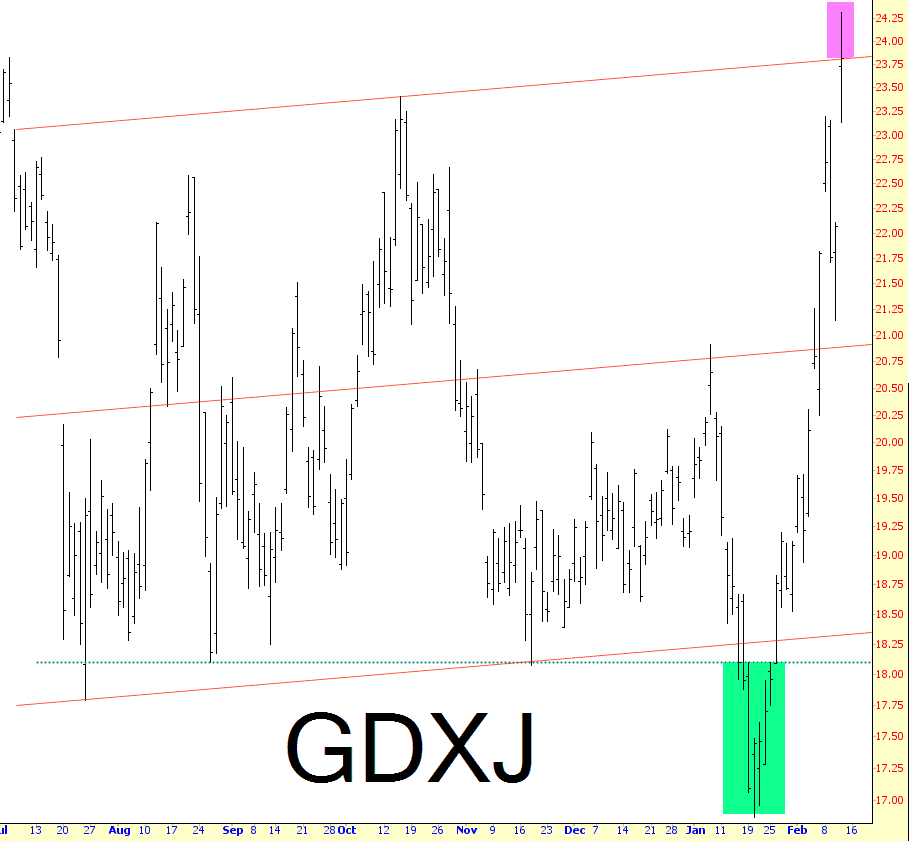

If it looks like a top, and acts like a top, and the Fed is not actively and overtly buying assets, then it should be a TOP in the SPX.

As we speak, the S&P 500 (SPX) is bearing down on its prior low at 1812.29 from Jan 20, which if violated and sustained, will trigger a next downside target zone of 1750/40.

More importantly, however, if such a scenario begins to unfold, then SPX will be on a larger downside path that has a trajectory towards 1580/40, thereafter.

At this juncture, only a sharp recovery rally that hurdles and sustains above 1900 will begin to neutralize Jan-Feb damage.