Here’s today’s swing-trading watch-list:

Short BE Aerospace (BEAV)

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

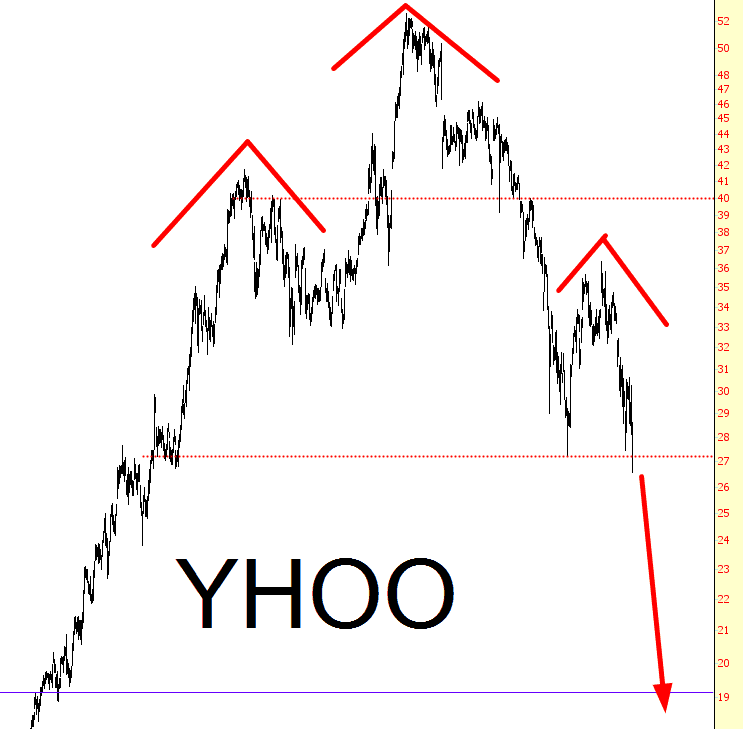

I’ve said it before and I’ll say it again: a mildly-attractive, wildly-narcissistic woman isn’t what is needed to save a failing Internet company, no matter how many vanity Vogue photo shoots she does. The analog in everyone’s mind was Steve Jobs:Apple::Marissa Mayers:Yahoo. Let’s see how that’s going:

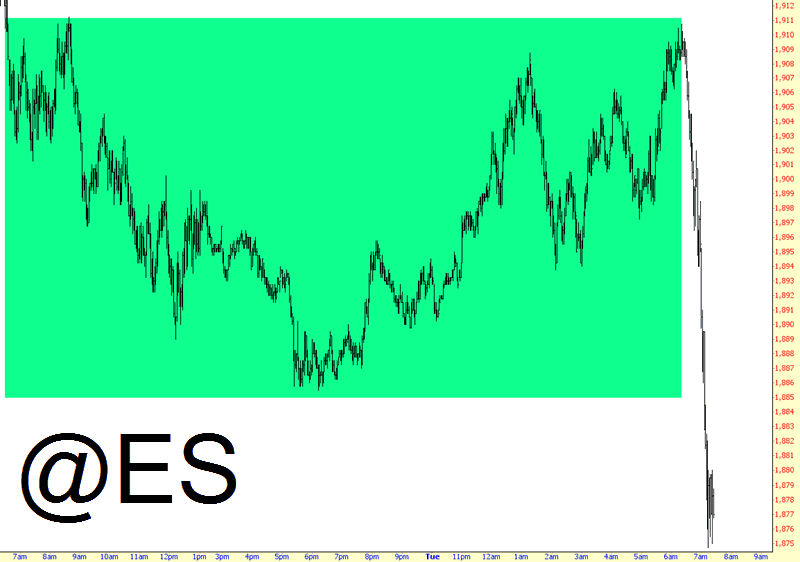

Some days things happen so fast after the open that by the time I get my post up much of the post is already out of date. This is one of those days. On the charts below I outlined a possible bull scenario and assigned it a possibly overgenerous 25% probability weighting. That is a lot lower now as the overnight rally failed hard at the ES weekly pivot at 1909, which was the key support level I gave on ES yesterday morning.

On the plus side I shorted the obvious resistance at 1909 ES and my runner from that trade is currently +33 or so, so I’ll keep my grumbling to a minimum.

On the bear scenario the rising wedge rally from the 1812 low broke down yesterday after an ideal 50% fib retracement of the falling megaphone from 2081, and as that rising wedge was a bear flag on the bigger picture. the alternate targets for the bear flag are either a retest of the 1812 January low, or the full flag target in the 1690 area. The high this morning was a perfect retest and hard fail at broken rising wedge / flag support. SPX 60min chart:

I confess that I was worried this morning. I had 120 short positions, 0 longs, and the intraday ES looked absolutely bullish. I’ve tinted the pattern below, and it looked like a very painful day ahead. However, as you certainly know by now, the rally-that-was-to-be fell to pieces immediately, and my profits are again soaring.

Given the torture I endured for years with these bullish turds, the amount of sympathy I have for such disappointments is simply too low to be measured, even with the most modern scientific instruments. As far as I’m concerned, the stock indexes should be permitted to do precisely what interest rates are doing these days: go into negative territory.

The bulls? Screw ’em all.