Here’s today’s swing-trading watch-list:

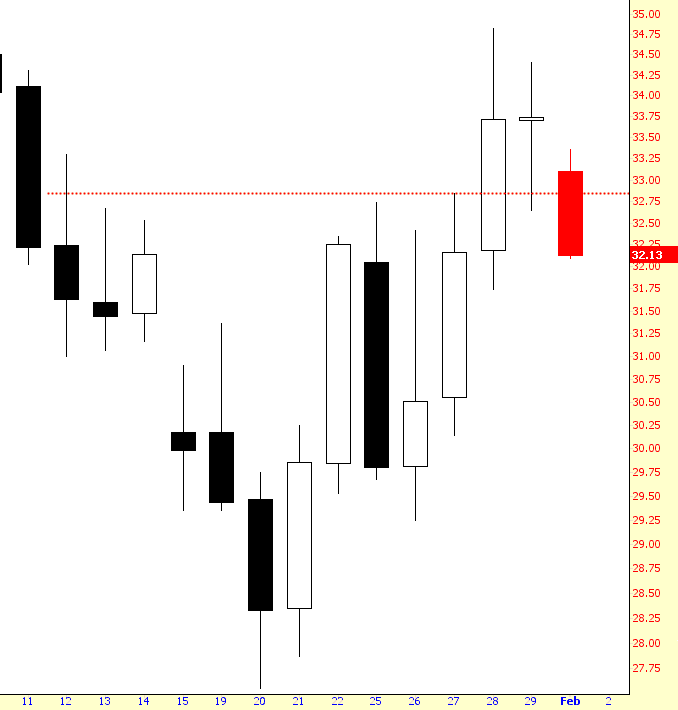

Long Mattel (MAT)

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

SPX failed to get back to 1990 by the January close, so I’m calling this year for the bears on my first three days of January stat. I outlined this setup on 7th January and you can see that post here. Of the six years in the last 43 years where this stat has fixed at the end of January the best two performers were up 3% and 1%, last year was marginally red, and the remaining three were down 10%, 11% and 39% (2008) respectively. The odds are against anything better than a flat close this year.

In the short term ES has broken up from an ascending triangle and I’m expecting broken resistance at 1912 ES (~1917/8 SPX) to be retested this morning. That might not happen as it has already been retested overnight, but we’ll see. The full triangle target is in the 2020 area, but these are bad at making target and Bulkowski recommends using a target at 61% of the full target. That would put this target in the 1978 area, which may well still be overambitious. ES Mar 60min chart:

I believe there’s an old saying about how it’s better to be lucky than smart. I’m seeing an example of that today, since I had been short Alere (ALR), and I closed it at a nice profit last Thursday. I see this morning that it’s up nearly 50% due to a takeover. That’s a bullet I’m glad I dodged. Sheesh!

It seems that the fantasy world of Kuroda (“negative interest rates will surely bring prosperity to the people”) has been shoved aside once more by reality from China (“down, down, down goes the economy”) and I’m seeing a lot of red that was annoying absent on Friday. Let’s hope it stays that way, with crude, once again, leading the way lower. Here’s the failed breakout: