In my travels to Slopefests and Expo’s over the last year I’ve had the pleasure of talking to many traders – some are profitable, some are not. My first question when someone is revealed to be in the latter camp is do you keep a journal. The answer is almost always no. I can’t say that a journal is absolutely required for long term success, but most successful traders I know keep one.

There is a difference between an effective journal and a useless one. I had never kept a journal until I started trading full time in June 2013 but I can say without hesitation I wouldn’t have made it this far without it. I didn’t have any hard plan or strategy – initially I was simply doing whatever I thought looked worth doing. I kept track of every trade I took and organized the data by strategy, instrument, chart pattern, even by time of day. It didn’t take long to hone in on what the most profitable categories were – then it becomes a matter of doing more of what works and less of what doesn’t – recognizing of course that this can and will change over time. (Clicking on any of these images will yield a larger, more readable version in a new tab).

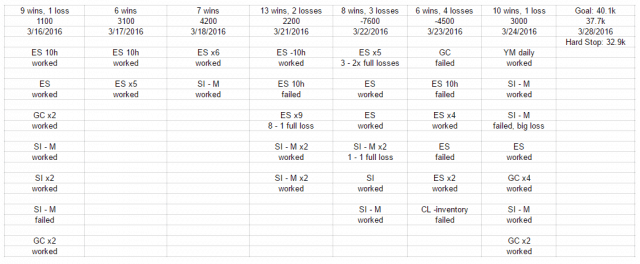

This is what my NADEX journal looks like over the last few days. ‘ES 10h’ is a setup with specific defined parameters – I want to keep those trades together when I do analysis so I can track how the strategy performs over time in different markets. ‘ES’ simply means any discretionary trade on ES that is not part of a setup. ‘ES x5’ just means I took five ES trades on the same expiration. ‘GC’ is gold, ‘SI’ silver, ‘SI – M’ a specific setup on silver, etc – you get the idea. The first step to any effective journal is organizing the data in such a way that when you analyze it you will get useful information.

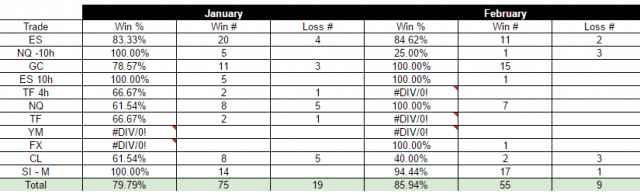

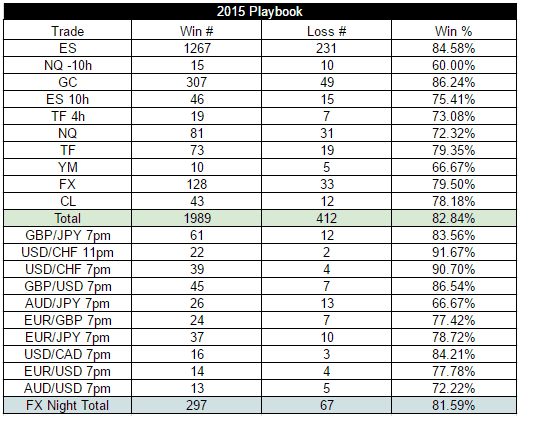

Here’s what my analysis of trades taken in January and February looks like. This data has incredible value to me but if someone were to show me the same thing based on their data, it would be next to useless. Take the ‘ES’ category – 20 wins, 4 losses for 83% win rate in January. How much do you make on each win? Lose on each loss? Is it a fairly repeatable method? Is the amount you make and lose relatively consistent or does it vary wildly? The answers to these questions will determine if 20-4 is profitable, not profitable, or completely useless information. Let’s consider you make $10-$15 per win, lose $40-$50 each loss, it is as repeatable as a discretionary method can be, and the win/loss amount is relatively consistent on each trade. Now this can be considered a fairly profitable category for this month – but with only 24 trades, it is hard to draw any conclusions about the long term prospects

Once you get data on hundreds of trades it becomes safer to draw firm conclusions. Even with a small volume of trades in a category, there is still value in seeing how the numbers stack up each month. This can give you a heads up as to when something that has been working seems to no longer be working – information that you can’t wait until year end to find out about.

Your journal should be easy to read, easy to analyze, and easy to understand. If you’ve been struggling lately and are looking for a possible solution, I’d advise you to try keeping a journal. I was basically flying by the seat of my pants when I started with few if any defined rules or strategies. Keeping a detailed record was instrumental in coalescing all of that into specific trading plans and setups. On ‘Shark Tank’ it’s always important that the entrepreneurs know their numbers – keeping a journal is the trading version of that. I know every time I push the button on an ES trade I have an 85% chance of making 15 and a 15% chance of losing 45. In other words, my expectancy for an ES discretionary trade is $6 per contract. It’s hard to see how you could know that number without a journal – and the trader who does not know their expectancy each time they press the buy/sell button is at a distinct disadvantage against the trader who has that information.