During these three-day weekends, I’ll sometimes lean on my Panic Prosperity and Progress book for an interesting morsel of content for my readers. Enjoy:

On a chart of the financial history of the United States, the downturn which took place in stocks in 1907 is a barely-recognizable blip. What took place during that year, however, would completely alter the financial structure of the world on a permanent basis. It is an astonishing story of what the financial universe of the United States was like before the nation had its own central bank.

In the early 20th century, it was not as if the U.S. had never had a central bank to call its own. Indeed, there was one in place long before, but President Andrew Jackson let the charter of the Second Bank of the United States expire in 1836, and the banks of the U.S. relied upon one another to navigate the roiling waves of the 19th century. Unfortunately, this system produced periodic panics and bank closures on a surprisingly frequent basis, and a depositor could not be assured of the safety of his money once it was deposited within an institution.

A Simpler Time

In sharp contrast to the modern financial world, understanding the mechanics of finance of the early 20th century is relatively simple. As long as one has a basic understanding of the importance of supply and demand, and how the interaction of those two elements affects price, it is relatively simple to comprehend the dynamics of what happened during those years.

In spite of its place as a relatively sophisticated urban center, New York City in the early 1900s was strongly subject to the cycles of agribusiness. The annual agricultural cycle had a profound effect on interest rates, money supply, and credit. Every autumn of every year, money would depart the city in order to pay for and ship the harvests taking place closer to the center of the nation.

At the same time, due to the scarcity of money, interest rates paid for deposits would rise, in an effort to attract deposits to replenish the depleted supplies of cash. Foreign investors could usually be relied upon to make those deposits. Thus, the financial rhythms of New York City were closely tied to the ancient cycles of the seasons.

Between October 1903 and January 1906, the Dow Industrial Average had risen from 42.3 to 103, an increase of 143% in the span of just over two years. The start-of-year exuberance of 1906 would not last long, however, as a number of bearish events emerged:

- In April of 1906, San Francisco was badly damaged by one of the worst earthquakes in history, prompting a large outflow of money from the nation’s money centers to the devastated region;

- In June of 1906, an offering of New York City bonds failed;

- In July of 1906, the Interstate Commerce Commission was granted power by the Hepburn Act to set railroad rates, thus depressing transportation stocks;

- In the same month, the copper market collapsed;

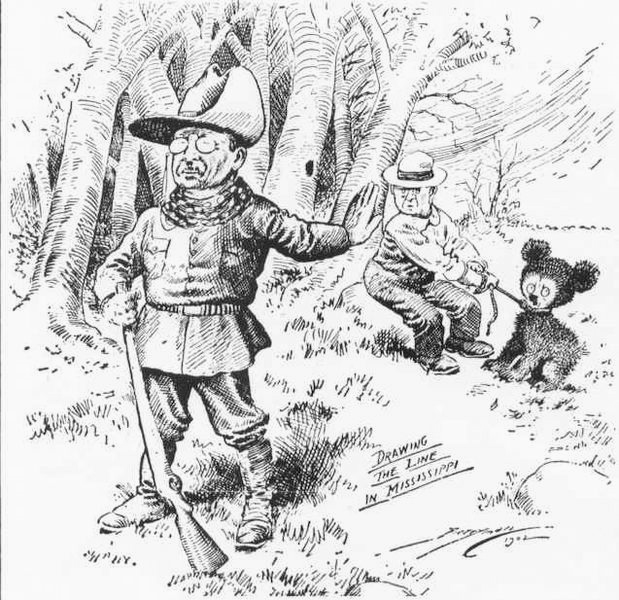

- In August, the Standard Oil Company was fined $29 million for anti-trust violations, and a widespread anti-big-business sentiment was sweeping the land, exemplified by President Theodore Roosevelt

By August, the Dow had lost about a third of its value. In retrospect, we can see the vast majority of the approximately 50% drop that would take place in the stock market actually transpired before the “panic” had even started.

It is also important to understand the role that trust companies had around this time. Trusts were formed in the 19th century as relatively conservative enterprises. They focused their business on managing estates, taking deposits (largely from the well-to-do), and holding securities. They essentially began as banks for the rich, but they were privileged not to have been subjected to the same regulations as state or national banks.

Because they were relatively lightly regulated, trusts were more at liberty to make investments from which other banks were foreclosed. For example, trusts were able to make collateral loans at high interest rates, whereas others banks could not. This added to the profitability of the trusts, and both the profitability and the light regulation made them attractive enterprises to start. Thus, trust assets grow 244% between 1890 and 1910, compared to national bank assets growing 97% and state-chartered banks growing only 82%. In short, trust assets were growing at triple the rate of the assets at state-chartered financial institutions.

The state of New York did institute somewhat firmer regulations in 1906, requiring that a trust maintain reserves of 15% of its deposits, but it only required 5% of the deposits to actually be available in the form of currency at the bank itself. This relatively thin cushion made trusts susceptible to “runs”, which were events in which panicked depositors would demand their cash back, thus threatening to exhaust the bank’s supply of cash on-hand (and, more important, the confidence in the institution).

Another political piece of the puzzle was that, in spite of Roosevelt’s firm anti-trust stance, the federal government was far less intrusive with respect to business and financial affairs than it is in the modern day. Indeed, for the entire summer of 1906, the President’s Cabinet didn’t meet even once, and once the crisis was in full swing, Roosevelt was busying himself trying to hunt down a bear to kill in the forests of Louisiana.

The Copper Magnate

Augustus Heinze was born in Brooklyn and was trained as a mining engineer. In Montana, he made a huge fortune as a mining promoter, and he earned a reputation as a combative businessman who was unafraid of taking large copper trusts to court.

His greatest success in court was due to a copper mine he owned which happened to be located near Amalgamated Mines. Heinze claimed that veins of copper emanating from his mine extended beneath the land owned by Amalgamated, and even though it was their land, he claimed the rights to the mineral deposits. A lengthy court fight ensued, and in the end, an out-of-court settlement of $25 million was made (in 1906 dollars), half of it in cash and half in Amalgamated stock.

Heinze took his massive newfound fortune to New York and aspired to become a banking tycoon. Early in 1907 he had established firm relationships with two of the city’s more powerful – – and rather unscrupulous – – bankers: E.R. Thomas and C.F. Morse. In those days, it was common practice to expand one’s banking empire through “chain banking”, which involved buying stock in a given bank, using that stock as collateral to borrow money, and then using that cash to buy stock in yet another bank or trust.

Thus, in short order, Heinze was soon in control of several banks and was on the board of directors of eight banks and two trust companies. With the right money and connections, it was not difficult to become a force to be reckoned with in New York’s financial district. Morse himself was a director of seven New York City banks, three of which he utterly controlled. In those days, the personalities of individual businessmen (and their reputation, whether good or bad) was closely linked to financial institutions, particularly given that there was no government insurance for everyday depositors.

Cornering United

Heinze and his cohorts hit upon a scheme they thought could substantially add to their fortunes: cornering the stock of United Copper. Morse himself was so stranger to cornering markets, as he had successfully cornered New York’s ice market (when there was such a thing). Because Heinze already owned a substantial block of United Copper stock, a successful attempt on their part to push the price higher would prove very profitable.