Screen capture via Cortexyme animation.

A Bigger Bubble Than The Late ’90s

Phoenix Capital Research offered an interesting comparison of the current stock market to that of the dot-com era of the late 1990s in a recent post (“Yes, It’s A Bubble and Yes It Will Burst Soon”):

Warren Buffett’s favorite measure for stocks is to compare the market cap of the stock market to U.S. GDP. By that metric, the stock market is more overvalued today than it was during the Tech Bubble of the late 1990s (153% vs 146%).

Suffice to say, this is a bubble. And technically it’s a bigger bubble than the Tech Bubble, which was widely considered to be the biggest stock market bubble of all time.

Maybe so. Maybe some good will come out of it though before it pops.

Taking Advantage Of Speculative Fervor

One of the companies that took advantage of the speculative fervor of recent years to go public is Cortexyme, Inc. (CRTX), a clinical stage biopharmaceutical company developing therapeutics for Alzheimer’s disease and other degenerative diseases. One interesting thing the company has been researching is the possible connection between the bacterium that causes gum disease and neurological diseases such as Alzheimer’s. CRTX caught our attention on Friday when it appeared in our system’s top ten names. Those are the stocks (and sometimes ETFs) we estimate have the highest return potential over the next six months.

A Big Milestone Coming Up In November

In mid-November, Cortexyme expects to have top-line data to share from its GAIN (GingipAIN Inhibitor for Treatment of Alzheimer’s Disease) trial. The company’s chief medical officer says it could be a big deal:

“We believe positive data from the GAIN Trial could fundamentally shift the paradigm of neurodegeneration research and disease-modifying treatment in the Alzheimer’s field and we intend to rapidly pursue collaboration with the FDA for the benefit of patients. Cortexyme is confident that we have enrolled the right population and that the study is powered to show a meaningful treatment effect. We remain steadfast in our mission to provide real change for Alzheimer’s patients and their caregivers,” said Michael Detke, MD, PhD, Cortexyme’s chief medical officer.

Let’s look at a way you can make some money if he’s right, while limiting your downside risk in the event this trial ends up being a bust — or the stock market in general deflates by then.

Shifting The Possible Outcomes In Your Favor

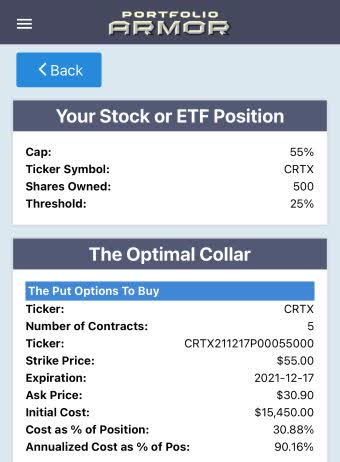

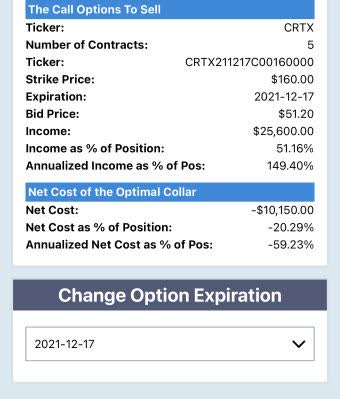

Since the results of the GAIN trial are supposed to be released in mid-November, we scanned December expirations to find this optimal collar on CRTX. This was the optimal collar, as of Friday’s close, to hedge against a >25% decline in CRTX by mid-December, while not capping your possible upside at less than 55% over the same time period.

Screen captures via the Portfolio Armor iPhone app.

Note that the net cost of this collar is negative, meaning you would have collected a net credit of $10,150, or 20% of your position value when opening it. Add that 20% to your cap, and your possible upside here is 3x your possible downside: 75% versus 25%.