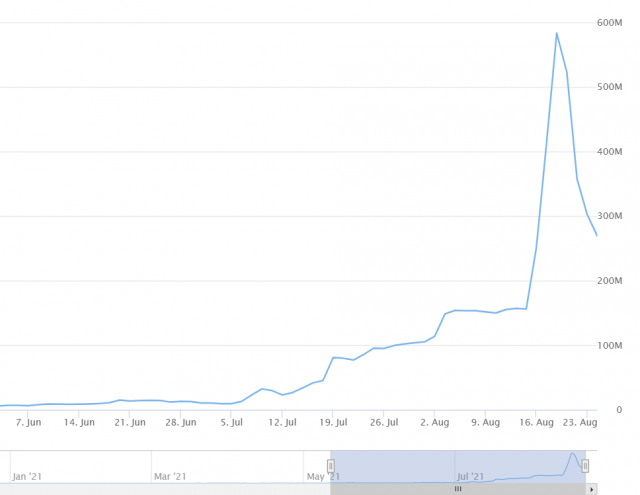

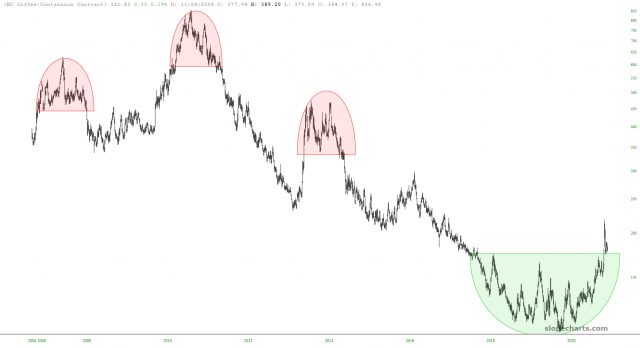

I’ve mentioned ceaselessly, both here and on the air, how “chart-friendly” crypto is. Well, that cuts both ways. The charts can tell me when they’re going up, and they can also suggest to me when they’re about to fall.

Slope is rather special in that we save a lot of intraday data, both for stocks and for crypto. Armed with this, I saw a series of intraday minute bar charts that were chilling to me. So I took my profits yesterday evening (with the exception of three positions, which I wound up closing Tuesday), thank you very much. I’ll get back in when the coast seems clear.