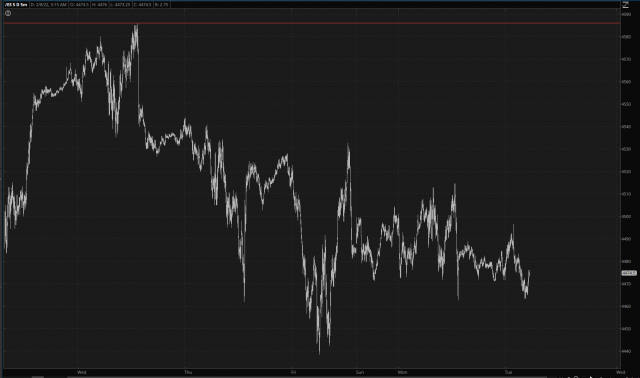

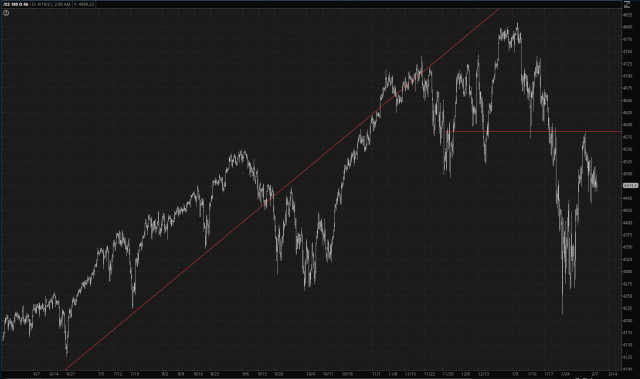

Howdy, people. Well, it’s an electrifying morning. as I’m typing this, the /ES is collapsing 0.04% and the /RTY is exploding higher by 0.06%. It’s even better than a weekend. In any case, the /ES has just been lumbering around, mercifully avoiding a breakout above that horizontal.

The bigger picture is absolutely unchanged. Tons of overhead supply acting as a barrier above, and an indecisive market below. Perhaps Thursday morning’s CPI will give it a jolt of shock so it actually does something.

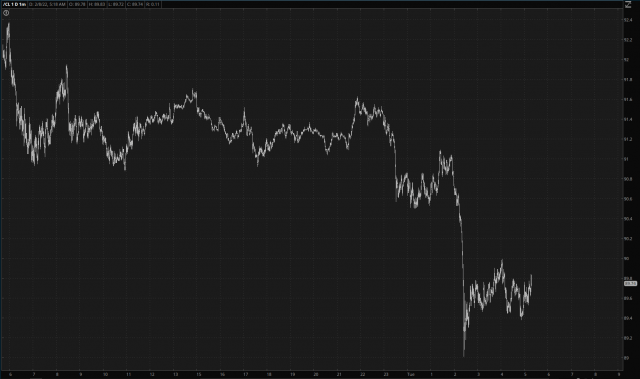

One unusual item is crude oil, which is down (for a change) by 1.25%. Considering crude oil has gone up every day since LBJ announced he wouldn’t seek re-election, it sticks out.

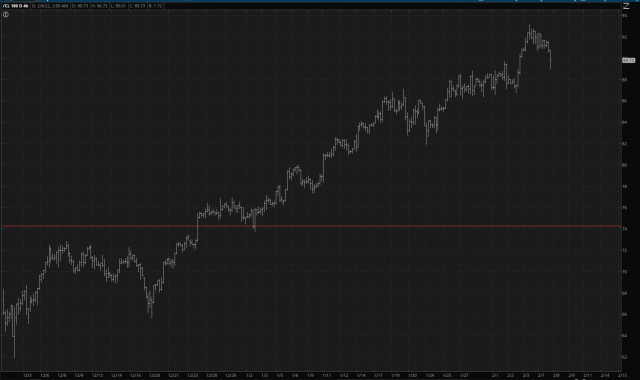

On a longer timeframe, though, it’s just a blip. My passion for energy bearishness has been evacuated, although I do have puts in APA…….but that’s seriously about it.

As for my own positioning, I’m in 30 bearish positions with an average expiration date 115 days out, and I’m in 24% cash. I’m still feeling a bit too skittish to get aggressive.