People truly never learn.

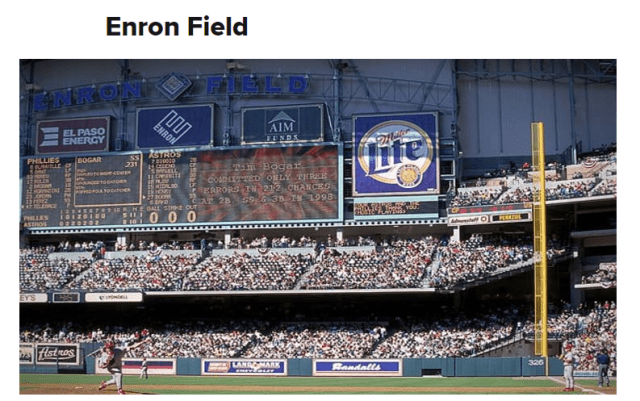

If you ask any five year old if paying big bucks to name a stadium is a smart business move, they’ll tell you “no”. History has provided countless examples of this. To cite just a few……….

At the turn of the millennium, all of these firms were very big deals. Now they’re all just a footnote in business history, since their absolute peak in wealth and power was approximately five minutes after their CEO signed the Stadium Naming Deal at some attorney’s office. Because you know what’s going on here. It isn’t because these are brilliant marketing ideas. It’s because some CEO who never got picked out for the softball team as a kid is finally getting his chance to wave his dick around in a manner he never thought possible.

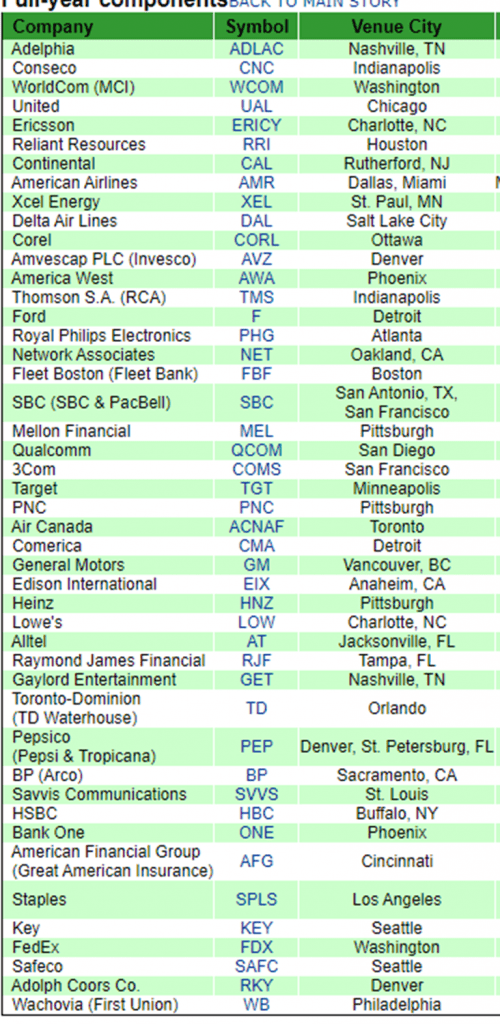

Indeed, back in the Internet Bubble, it became a regular exercise to track what foolhardy companies would dump billions of bucks into the misguided notion that slapping their name onto a sports arena would magically produce gobs of new customers. You won’t recognize a lot of these names, because they’ve gone bankrupt, or at least are shadows of their former selves.

One of the latest, of course, is the Sofi Stadium, which is where the Super Bowl was recently held. Sofi paid $625 million to slap their name on this thing, and I daresay 99% of the attendees and viewers neither knew nor cared what Sofi was or did.

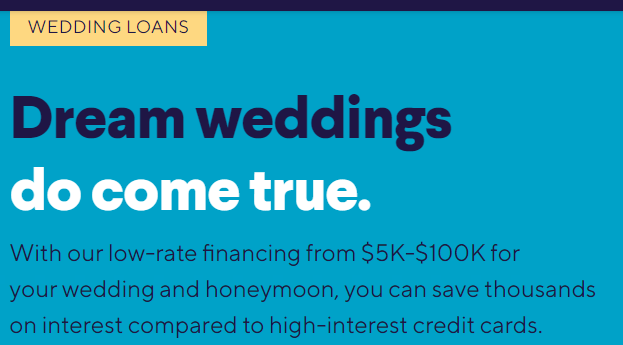

Their business model is easy enough to understand, though. They lend money, mostly to students and others without the world’s best credit or resources. During the easy money of recent years, it might have been plausible, since they could borrow funds at 5% and loan them at 16%. They made a name for themselves mostly doing student loans (which sort of tells you how shaky their books must be), but they have dozens of other offers, such as…………

Yes. Yes, for the love of God, they’re actually pushing loans of up to $100,000 for young people to have some blow-out wedding bash. Setting aside the foolhardiness of such an expense, their entire twist is that, yes, you’re going to spend a fortune on principal and interest, but it would be even worse if you charged it all to your groaning credit card balances. They position this as being “savvy“.

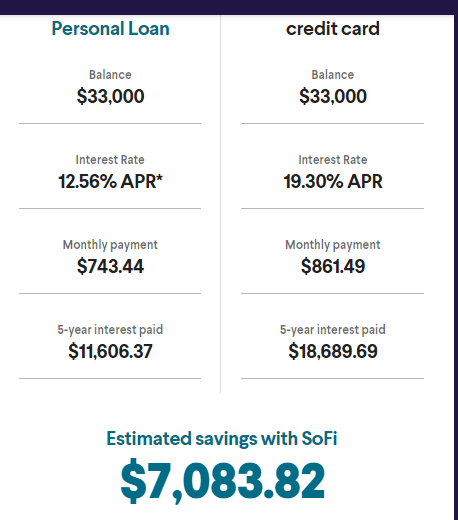

And they offer proof in this simple example, in which they propose what I suppose is a modest $33,000 wedding (a mere third of what is suggested above) and shows that, after being burdened with monthly payments for 60 months after you’ve hosted the goddamned thing, you have “saved” yourself over $7,000 in interest compared to a usurious credit card. Left column: lube. Right column: no lube at all. Pick your poison.

The good news is that the young couple will be so strapped for cash, they won’t even be able to afford a family law attorney in case things didn’t work out so great after the honeymoon.

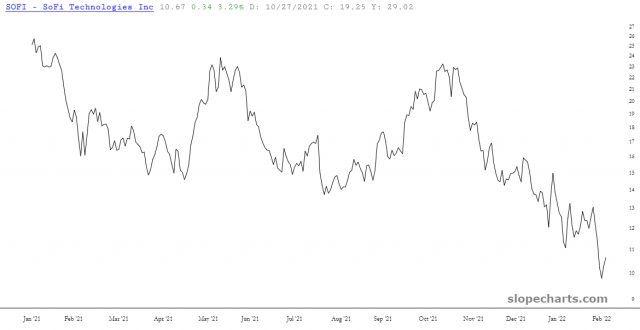

If you think the notion that Sofi isn’t setting the world on fire as a business following this deal is just a curmudgeonly hunch, I present to you their stock price, which has lost around 60% of its value in a matter of months.

Not to be outdone, though, Crypto.com spent even MORE than Sofi:

The idea being, once again, that the numbskulls who actually would elect to spend their evening watching a basketball game are also just itching to get into the frisky world of cryptocurrency trading, if only they could find a really cool broker.

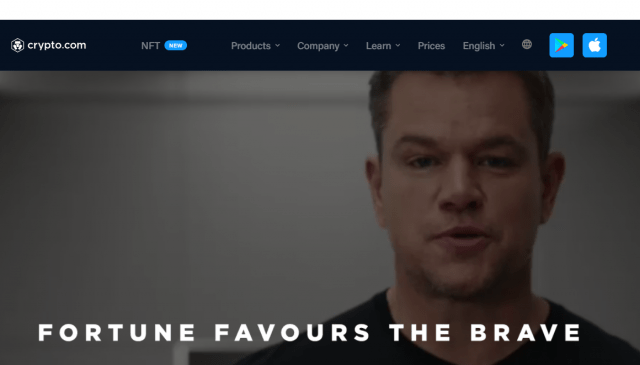

And, since apparently Crypto.com has unlimited fund to throw around, they also dumped a ton of cash on Matt Damon so he could do an advertisement for them. I strongly suspect, however, over the course of the next few years, the company’s image will morph from something like this………..

……..to this: