Happy Friday, everyone. I am composing this, as I normally do in the mornings, well before the opening bell. I wanted to make a point of saying that since for some reason the cash open seems to do weird things to the market, so my observations are based on pre-market data.

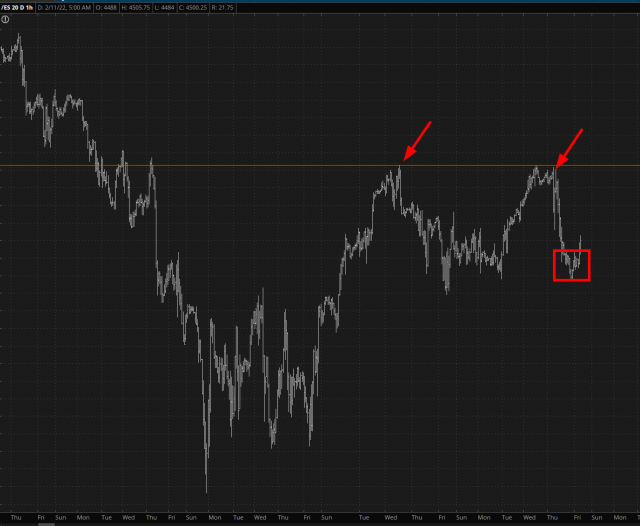

When I called it a day last night, all the equity futures were crumbling lower, but, how about that, Powell & Company have saved the day again with an inverted H&S on the /ES.

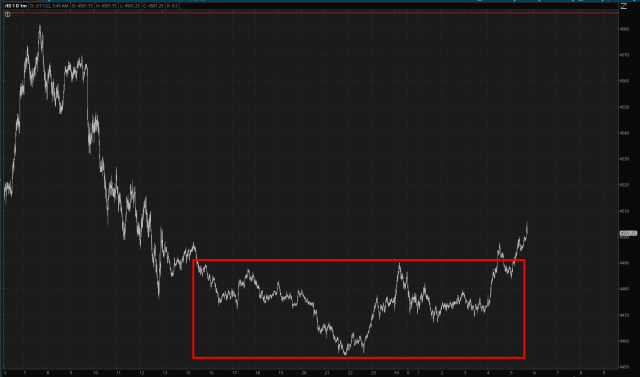

But this needs to be kept in context. The scary bullish pattern above is, on a larger scale, a pipsqueak nothingness (which I’m emphasized on this chart with a rectangle………..if you can see it). The more important “event”, which happened 24 hours ago, was the rejection of prices at the horizontal.

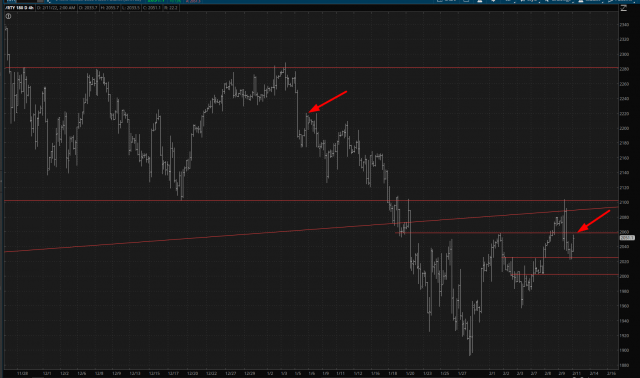

The above two charts are of the S&P futures (the /ES) but below is the small caps (/RTY). In my opinion, the “You Are Here” analog is marked with the arrows I’ve placed. We are at a spot in which, as before, we attempted to burst above a bullish patter, failed to do so, fell hard, and recovered briefly. The last instance, it was simply the first step in a much longer staircase.

To put it another way, I think the die is cast. The bulls are going to fight, and fight, and fight again, just like they did yesterday (and rather comically), but the big picture tells the story. Simply stated, this is one of the cleanest, plainest, most compelling reversal patterns I have seen in a career in which I have observed countless millions of charts almost every day of every year for decades.