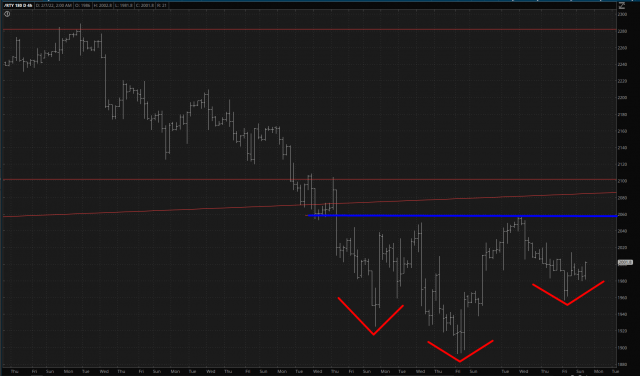

Good morning, everyone, and welcome to a new week. I wanted this post to be about a specific threat I see to the handful of equity bears left on the planet. It is a threat which has existed before, and was quashed, but worrywart that I am, I wanted to review it. It is the prospect of a bullish inverted head & shoulders breakout on the /RTY small caps (which, if successful, would be of aid in lifting the entire market up). Here is the recent price activity, which is fairly meaningless in the short-term. We’re basically at exactly the same level we were at the close of the cash market on Friday.

Take a step back, however, and you can see what I’m worried about. There are a very well-formed IHS pattern, about 90% complete, which would be complete if it pushes above that blue horizontal line I’ve laid down. We are forming the right shoulder of this thing right now, and crossing above 2058.40 would do the trick.

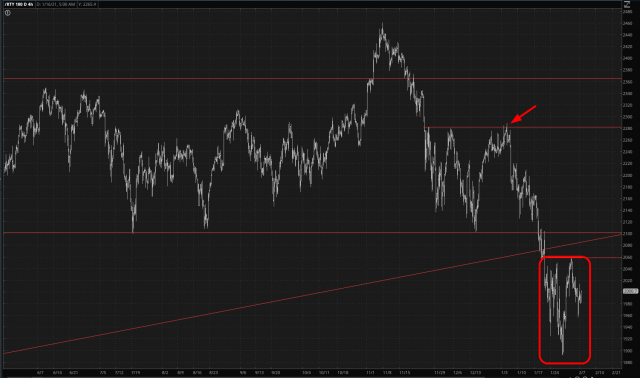

This concludes the worrisome part of my post, because I’d like to introduce a few reasons it isn’t such a huge deal. First of all, we’ve been through precisely this kind of thing before. Not long ago, there was another bullish pattern forming. I was worried then. AND is broken out. And what was the consequence? The bulls held the baton for about 3 minutes (see arrow) before it rolled over and went into a death spiral. Ironically, the best time in the world to short the hell out of everything was the millisecond it seemed the bulls had beaten us again.

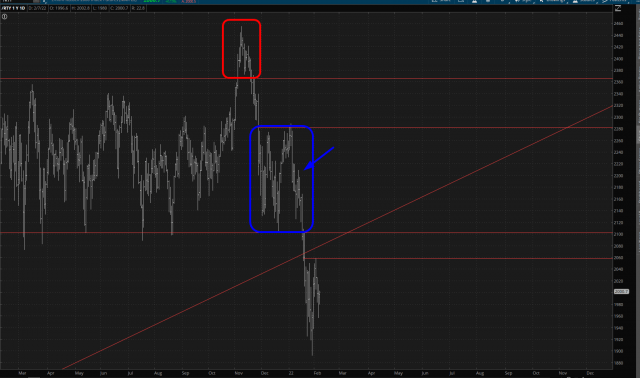

Let’s go back any further. Below I’ve highlighted the failed breakout in blue. There was another bullish pattern – VASTLY larger – which (a) finished (b) broke to lifetime highs (c) actually worked for about a week. That’s marked with the red rectangle. And, once again, you can see that was actually a turning point, and indeed it marked what is very likely to be the highest level of the Russell has ever reached for years to come.

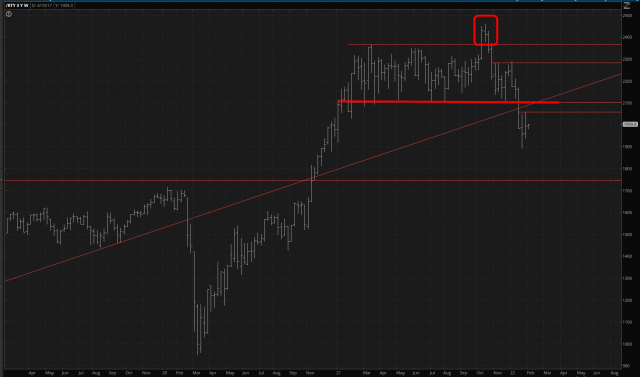

And here is the final, and longest-timeline, chart. You can see the breakout with the red rounded rectangle, which (again, ironically) marked the top. As I mentioned last week, our main ally – – our English Channel, as it were – – is the thick red horizontal line and all the price activity above it. Breakout or no breakout, the bulls aren’t going to get through through fortress. It is a massive pattern which took a year to form, and it is our most stringest ally.

My conclusion is that medium- and long-term, the bears are A-OK, but short-term, yes, there is risk, because we’re in the middleground of a fairly wide range of prices. Now that all the cool earnings reports are behind us, things are going to sputter once again to the two main drivers of price, which are the talking heads from the Fed and exogeneous geopolitical events .I am “medium aggressive” at the moment, but presently hold 20% cash as a precaution and for new opportunities.