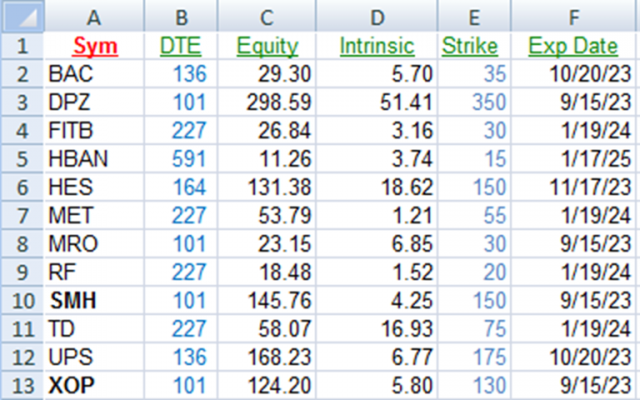

There is no need to create an indicator called Tim Knight’s Interest in Trading. They already have one. It’s called the VIX, and it’s at the cusp of breaking to a 13-handle, a multi-year low. I’m the guy who will cheerfully take on 40 different positions at once when trading is a blast. These days…….not so much. I am extraordinarily light right now, with over 30% cash and a mere 10 stock positions (and 2 ETFs). I rarely do this, but here is my entire portfolio:

The data is fairly self-evident, but to be clear:

- Symbol is the underlying symbol of the option;

- DTE is the Days ‘Til Expiration;

- Equity is the present underlying equity price;

- Intrinsic is the intrinsic value of the option;

- Strike is the strike price;

- Exp Date is the expiration date

This market has me bored out of my skull, which is the polar opposite of where I was about precisely one year ago, which was a Bear’s Paradise. I shall focus my attention on creating new features and products here on Slope as I await for a bit of sanity to return to these confounded equity markets. It’s really quite discouraging.