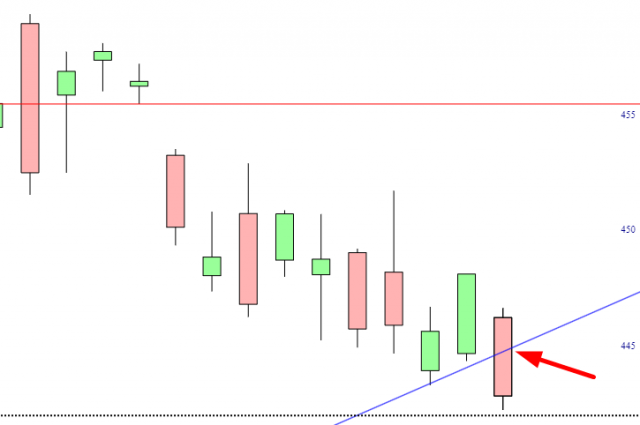

Last night, the bulls put together a little basing pattern and achieved a breakout in the wee hours of the morning, only to see it unwind and produce another red morning for the bears.

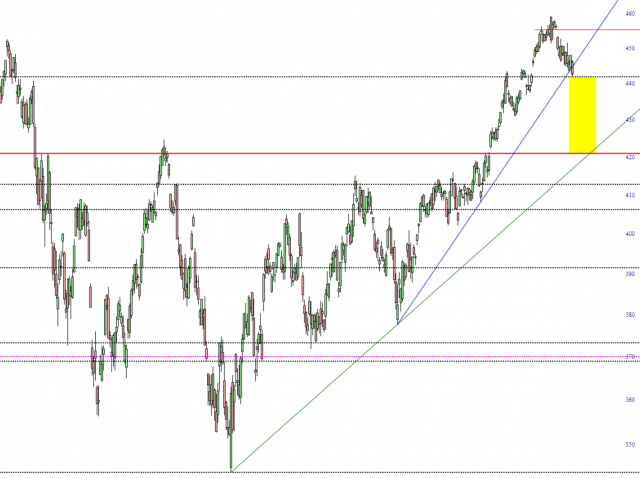

More important than this minute-by-minute wiggles and waggles is the fact that yesterday, for the first time, the March 13th trendline was broken. This is a big deal, in my estimation. That pig Yellen established the anchor point for this trendline by her criminal bailout of her banking friends (now clocking in at $110 billion in handouts for fellow gangsters). Let’s face it, the woman has no true friends, so she’s gotta score them somehow. This act on her part created incredible new fake value in the market, but in recent days, it’s beginning to sour. This trendline failure is probably the best thing that’s happened to the bears all year.

For the year 2023, I have dispensed with any wild-eyed dreams about a big wipeout, but, as you know, I certainly have ambitions about enough of a diminishment in prices to create true opportunity. I believe it is reasonable to postulate that the SPY could traverse the zone I’ve tinted below before Yellen and/or Powell come up with another criminal scheme to “help” everyone.

Of course, I’m all the more applauding the XLU breakdown, since that is my anchor position and I’m watching it like a hawk.

My portfolio remains fully loaded, so day by day all I’m really do is tweak around the edges and make adjustments here and there (more often than not, to my detriment). I have 14 equity-based put positions and 1 ETF put position (XLU, of course), with expirations ranging from 156 to 212 days from now.