We live in a world that’s never been more buried in debt. I distinctly remember as a kid that the news was ablaze with shock that, for the first time, the United States was over one trillion dollars in debt. It was an unimaginably large number, and it felt humiliating as a nation to see what bums we had all become.

Let’s just say that, $32 trillion later, and trillions more accruing constantly, we’re well past that. We’re quite content with being helpless debt addicts. The thing is, though, that bonds are starting to collapse anew, and that means just one thing: even higher interest rates.

You can see this reflected in TBT, the ultrashort bond fund, which is representative of interest rate direction. You think going from 2% mortgages to 7% was bad? Wait until it goes into the double digits. Real estate is going to have a massive coronary.

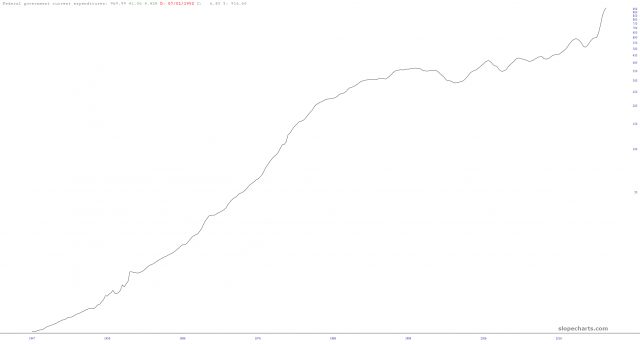

And, and as for that shocking one trillion dollar figure? I’ve got another one trillion dollar announcement for you. Below is the chart of how much the U.S. shells out in interest payments each year. Seems like a steady uptrend, doesn’t it?

Recently it made a big inflection point so it’s practically vertical. Well, guess what? We’re about to pass the one trillion dollar level of interest payments PER YEAR. That’s right. What was once considered a shocking figure for the entire debt is now an all-cash expense right out the door, year after year, and it’ll just keep climbing.

Think we’re heading for a happy ending in this living Disney movie? Think again.