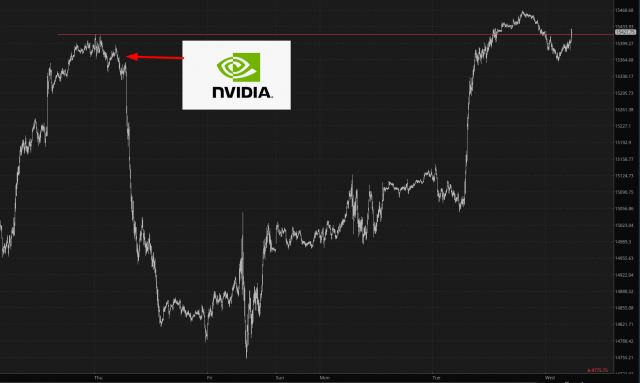

Good morning, everyone. Since evidently there’s no multi-month revision to faulty government data this morning, the markets are mellow and borderline boring. The /NQ had a tremendous surge yesterday, surpassing even the peak witnessed last week with the Nvidia blowout earnings.

The small caps formed an inverted H&S pattern and zipped higher. THey will need to slip below this pattern level to neutralize it.

Looking at the bigger picture on the /ES futures, the Fibonacci resistance is as plain as day. It’s important we do not exceed the level I’ve circled.

As for the bonds, whose renewed weakness are key to the potential for bearish equities, they are still engaged in a clean series of lower lows and lower highs. Yesterday didn’t change any of that.

Finally, and not at all a surprise, volatility has been smothered to death in its crib. We’ve gone from the 30s to almost the sub-teens. It’s just breathtaking, and if we DO get a real diminishment in stock prices in the weeks ahead, this could be an amazing bargain at these levels.

It’s good to be home!