This is just a follow-up to my previous post, but with regards to the other major indexes.

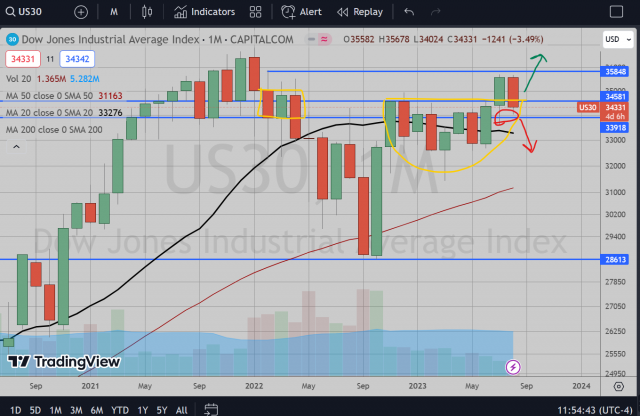

Starting with the Dow Jones, this is probably one of the cleanest bullishly positioned indexes in terms of breakout points yet showing short-term weakness in August, which is why I am leading with this. We are at a major test of this breakout here. This is a do or die situation for this index. If this doesn’t manage to close back up and start off September strong, then this could fail here, essentially becoming a failed bullish breakout from July, and thus likely ending in December a good bit lower from here.

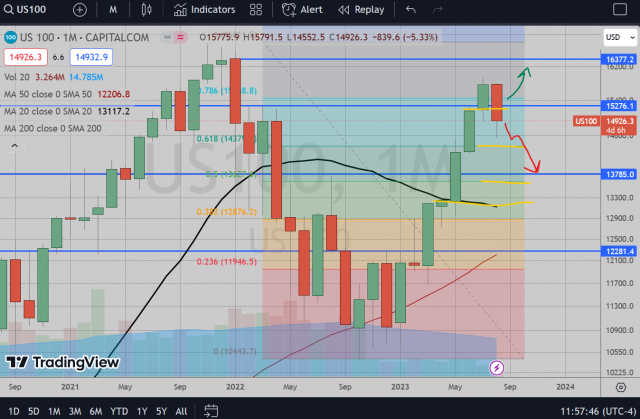

Nasdaq, similar to the SPX this is on the cusp of setting either a decent reversal or very bullish rest of the year. Failure to fall here = September engulfing green (in my mind at least) up to potentially new highs by the end of the year. Tech has consistently led the past year, so it is hard to tell where this might find support if we do see any kind of reversal. I highlighted a few spots based on the Fibonacci retracements and prior congestive zones.

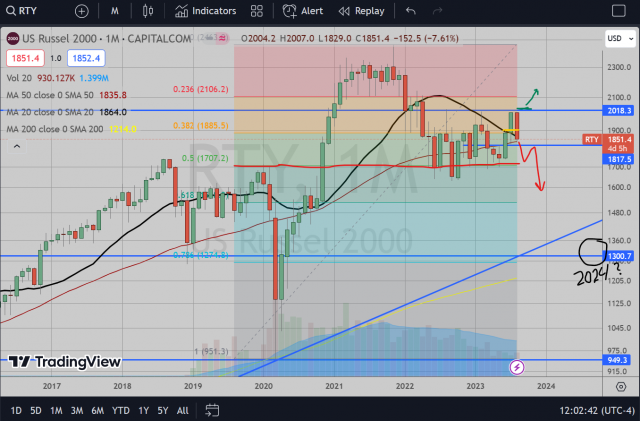

Russell, the weakest of the bunch. Perhaps we are seeing the small caps finally lead down in this environment of high rates (I imagine the small cap companies would be most easily hurt by the expensive debt we will be seeing for the foreseeable future). This had a breakout attempt much like the rest of the indexes, but August rejected that 2k level pretty harshly so far.

Like the Dow Jones, this is a do or die situation, but much better positioned bearishly. This is already beneath the breakout levels in terms of price (though still in a congestive area with Moving Averages). A bullish close back up could shoot us back up, but I wouldn’t feel truly bullish about this index until it breaks up above 2k, and right now that looks like a tall order.

If a we get a bearish close here with September weakness then may see the biggest drops occur in this index versus other indexes (think regional banks). 1700 has proven itself massive support zone in the past year, but major support or not, when levels get test over and over like that I’d expect a break eventually. Anyone getting long over the past year is getting ulcers in this index I am sure as it is not performing anything like the others. A break of 1700 could yield a large drop towards 1300 area at least by early to mid 2024, but that’s a long way off. Let’s wait for the break first.