Join everyone over on SlopeTalk as we watch the Powell presser together.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Join everyone over on SlopeTalk as we watch the Powell presser together.

Over the weekend, I did a video about three big lessons I learned recently. Contrarian that I am, even to myself, I want to run directly into one of these and debate it: specifically, the point about how real profits come from LARGE quantity positions that are shorter-term in nature.

You see, I track not just my active positions but also the ones I close. I want to see how good or (more commonly) bad a decision I made by getting out.

What struck me this morning, when I sorted out the “would have been” percentage values, is that the BIGGEST gains, both percentage-wise and dollars-wise, were in tiny positions (like 4 or 5 put options) in expensive names. Specifically, Albemarle (ALB):

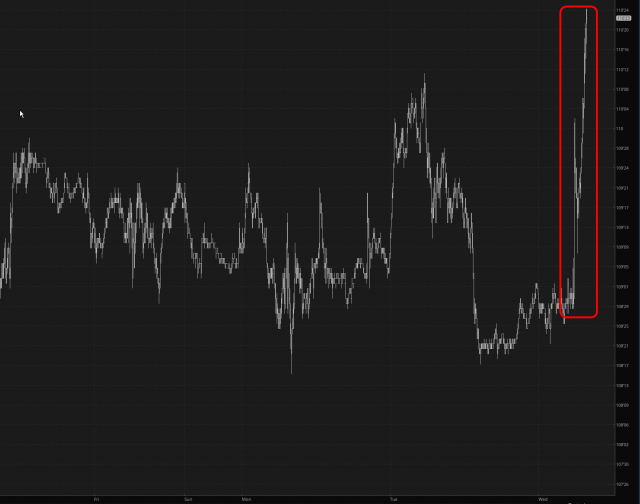

Yuck! I’m not liking this week one little bit! The ONLY good thing is that I lightened up so much, so the damage is attenuated. And what financial instrument is yanking the bulls out of the quagmire and into victory? Bonds, of course………..

As we await the Fed later today, enjoy these charmers. I meant to show them for Halloween, but we’ll do them for All Saints’ Day instead………..