Last night, I did a special post for our beloved Gold and Platinum members called Index Points, whose main point was that we were beautifully positioned for a hard reversal, since we had snapped supporting trendlines so perfectly. Well, this morning it wasn’t looking so good, but a couple of hours before the close, we got some action, Jackson.

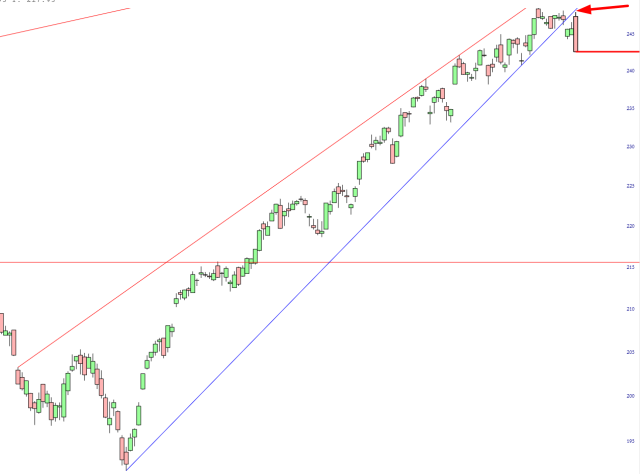

Honestly, these are the kinds of charts that come along once a decade or so. Here is the SPY with a PERFECT, and I mean PERFECT tag of the broken trendline along with a gargantuan bearish reversal pattern. What a refreshing change! It feels like the first down day in a century.

The OEF has precisely the same setup.

I remain short (by way of long September puts) in FXI, XLU, and GDXJ. XLU is my biggest position, and it’s been quite frustrating lately. It did manage to go down a little today, but honestly, it really needs to start selling off hard for me to get excited about this again. The diamond pattern is the driving force.

It’s very early in the day for me, but I’m not sure if there’s anything else worth saying until the jobs report in the morning (and its reaction!) Also, I’m getting geared up for the eclipse, which is a really big deal for me and will definitely be driving what I write about over the weekend!