Good morning, and welcome to the first day of the quarter in which we don’t have to endure lame April Fools jokes, especially from companies that think they’re being cute.

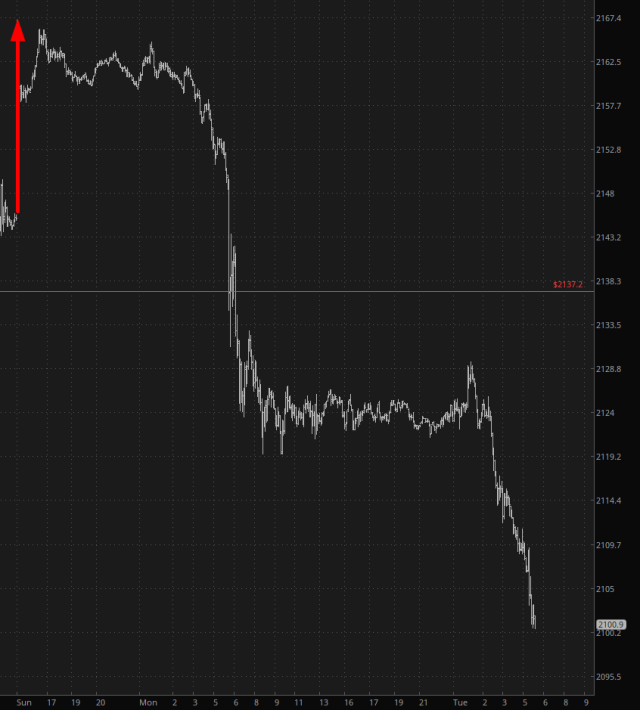

It’s a sea of red out there, which is a welcome change from the ridiculous, debt-fueled, and totally unsustainable mega-rally of Q1. I’ve marked in the next three charts the huge surge on Sunday when futures opened, egged one by the fake PCE number which “traders’ hope the Fed will use as an excuse to slash interest rates. here we have the /NQ……

…….the /ES.……..

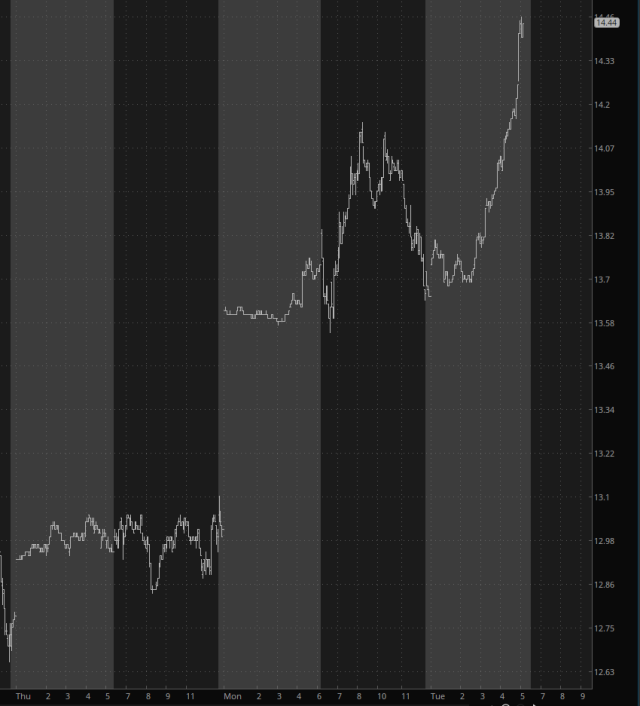

……and the /RTY:

As you can see, in all three cases, the enormous buying on Sunday has been met with nothing but losses. Again, it’s a nice change. May there be trillions more losses to come.

The VIX, which recently was just about at an 11-handle, has spike up to 14.44. Errr, wake me when it’s 90, all right? These days, however, 14 is practically crash territory. Maybe CNBC will do one of those lame Markets in Turmoil graphics.

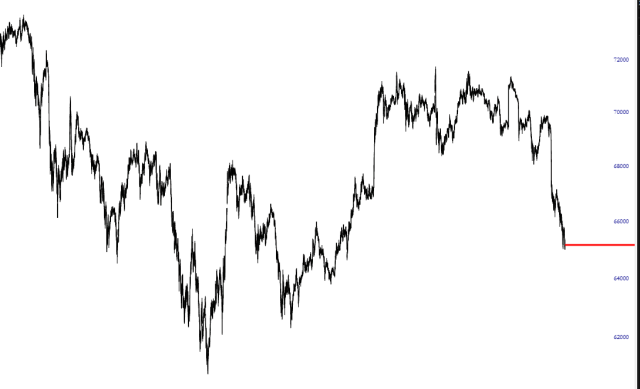

Finally, Bitcoin is getting zapped again. In recent weeks, it peaked at almost $75,000, plunged by $10,000, recovered the lion’s share of that, and has given up most of those recovery gains once more.

Wouldn’t it be funny if, say, five years from now, crypto was seen as just a widespread madness, and people agreed it was hysterical that people value BTC at way more than a trillion dollars when, all the time, it was nothing more than a gambling token?

Just a thought.