This isn’t meant to provoke political discussion. I just love maps, and I love political races, so I find these extra interesting. Nothing more.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

This isn’t meant to provoke political discussion. I just love maps, and I love political races, so I find these extra interesting. Nothing more.

Normally, when one is hunting for intriguing short-sale setups, he might think the way to go is to look for something that’s really expensive and near lifetime highs. I’d like to offer a fresh example of something that doesn’t fit this mold.

Here is Unity Software (symbol U) which, as you can see by the tint, is sporting a remarkably well-formed head and shoulders pattern. It has all the characteristics you’d want to see: a well-defined shape, an easily identified neckline, a sharp drop, and a full retracement. This looks just a great place to short, or at least watch very closely to enter a bearish position.

I have long held the belief that popular media offers potent contrarian indicators. The “cover curse” is the most famous, but I’d like to mention a rather curious one specific to our own little industry here: Zerohedge.

See, ZH came into existence in February 2009 (our own beloved Slope was already four years old by then). Right from the get-go, and for years and years after, it was steadfastly cynical, critical, and very bearish. Understandably, I was a big fan. Plus, it made sense that this very bearish publication came out at the almost EXACT bottom of the bear market, which would take place just days later.

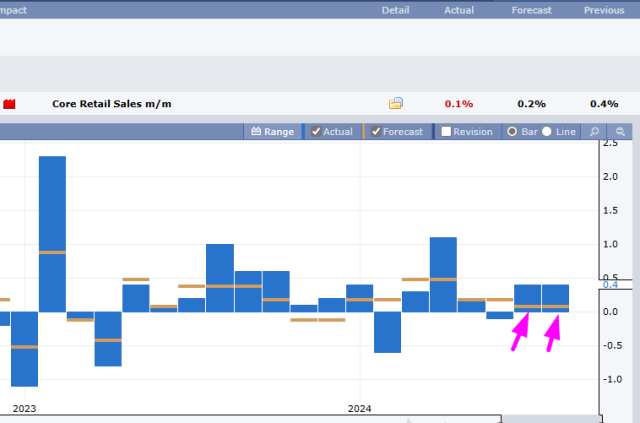

(more…)As we all await Powell tomorrow, and the market just keeps grinding its way higher, the retail report came out. For the second month in a row, it was a big miss, aligning with my judgment that we are in a recession and are heading much deeper into it. Weirdly, this bad economic news is just what the bulls wanted to see, since it feeds into the interest-rate-drops-are-good narrative.