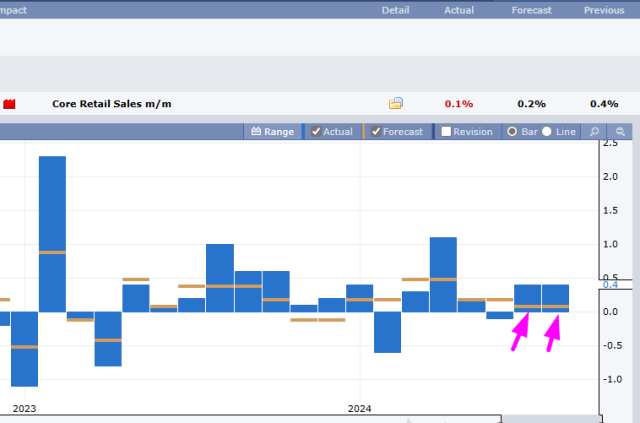

As we all await Powell tomorrow, and the market just keeps grinding its way higher, the retail report came out. For the second month in a row, it was a big miss, aligning with my judgment that we are in a recession and are heading much deeper into it. Weirdly, this bad economic news is just what the bulls wanted to see, since it feeds into the interest-rate-drops-are-good narrative.

Ever since last Wednesday morning, the market has done nothing but go up in anticipation of the first interest rate cut in four years.

Looking at the daily bars for the /ES, you can see we have bounced mightily off the Fibonacci levels (with extraordinary accuracy) and are set up to challenge the lifetime high set up in mid-July.

I remain relatively light at 33% cash, and I will maintain that conservative position until very late tomorrow, well after Powell, if not Thursday morning.