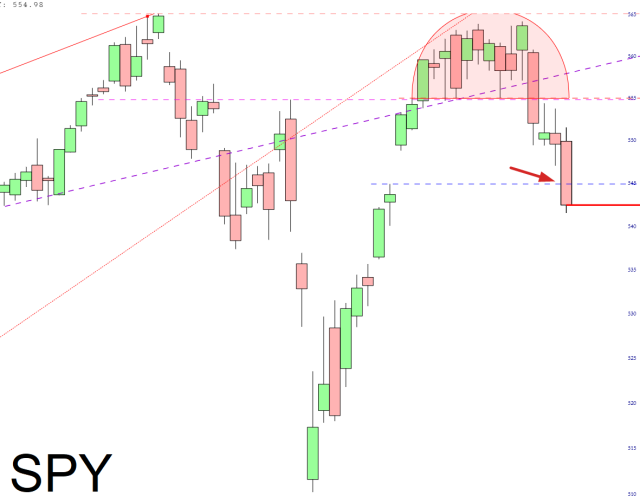

The price gap on the SPY (and $SPX, obviously) offered little in the way of support. We’ve sliced right through it. This opens up the opportunity for September to be not just good for the bears, but great.

I also applaud the behavior of EFA, which is far and away my biggest position. I’ve described this position as “irresponsibly large“, although I took profits on about 23% of my position at good prices today. It is now simply “really big” without the irresponsible part. I’m hanging on to the rest.

Overall, I remain exceptionally short with a total of 15 separate positions. This shortened week turned out to be by FAR my best of the year. Huzzah!