Good morning, everyone! I’m so excited about the next two weeks, because the market has been incredibly chart-friendly, and there are so many market-moving events coming up. There’s the debate tomorrow night, the CPI on Wednesday morning, and the FOMC the following Wednesday. Even more important, the market has its head spinning right now, and surfing the waves of the market psyche will be an exhilarating challenge.

Just as I was hoping, the market has staged a countertrend rally and has been hammering out a price ascent from the moment it opened Sunday evening. I’m delighted, but that was the easy part. It gets a lot harder from here, especially for an impatient soul like me who wants the bounce to be done as soon as possible.

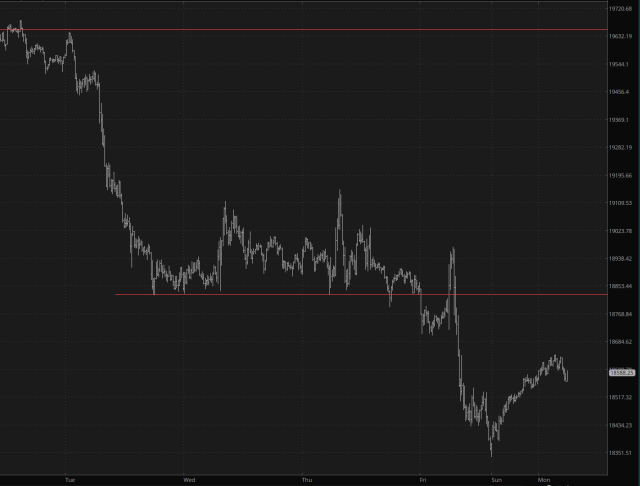

My own personal quirks aside, the real tough part is distinguishing between a substantial counter-trend rally (such as the horrible thing we endured from the morning of August 5th until the 30th – – virtually the entire rotten MONTH of August!) and the pipsqueak not-even-a-single-day efforts like I’ve highlighted on the longer-term /ES chart below.

It’s the same with the /NQ, which has burned off the really oversold nature of Friday’s price action and is now, even before the opening bell, seeming to turn flaccid.

Looking at the longer-term /NQ, you can see why. To call a chart like this “vulnerable” is to put it mildly. Matching the August 5th lows would be a cinch and breaking it wouldn’t be much tougher. I strongly suspect we will do so before this month (if not this week) is over.

Happily, in anticipation of this rally, I trimmed back my positions rather substantially on Friday, raising cash to nearly a third of my portfolio, and I acquired two large hedges.

One of them, the triple-bullish-on-semiconductors fund SOXL, is up, but as my mother used to say, it’s nothing to write home about. I mean, honestly. This is TRIPLE leveraged, and it’s just sort of meekly crawling higher by maybe 4%. All the same, I’ll take it. I wanted to have SOME kind of participation in the rally, after all.

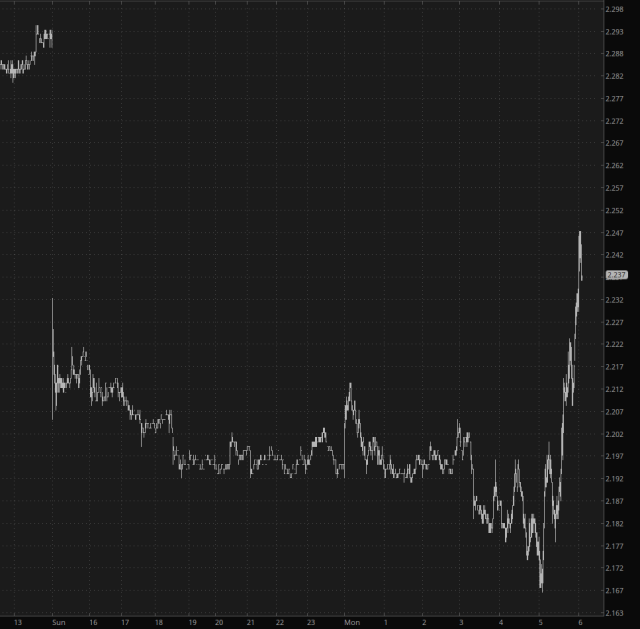

The other hedge, BOIL (double-bullish on natural gas) isn’t so clear, however. This requires a bit of explanation.

See, I only traded BOIL for the first time in my very long life last week, and I made a nice profit on it without even have to bother with any loss at all in the interim. It was a good trade right from the get-go.

This time I wasn’t so lucky. I bought a VERY large position in BOIL late on Friday, and it closed the week with a small loss (literally like down 0.1%, so BFD). On Sunday, however, the /NG futures gapped lower by 2.5% and just crumbling from there. With my exceptional and globally famous math skills, I was able to ascertain that a 2.5% drop translated to a 5% drop, and that was Not a Good Thing.

Natural gas futures got down to about a 4% loss, which made me really not a fan of BOIL anymore, but this for reasons that I neither understand nor care about, it has been recovering…….

So maybe BOIL will survive the day. I’m going to stick with my original stop-loss value, emphasized below (and BOIL was way below this pre-market!) and we’ll see if this hedge somehow makes it out of this alive.

So, in summary:

- My SOXL hedge is working, and we’ll see if I scamper out of it early today or, if the market exhibits an ability to push another leg higher

- My BOIL hedge isn’t necessarily doomed, as I was sure it would be only an hour ago

- I am maintaining my 2025 and 2026 puts, which are already very profitable and whose price targets are miles below where we are at now

- I am keeping a sharp eye on a bevy of other short positions I’d like to enter at good prices.