The first four days of this week were the exact opposite of the four-day trading week that preceded it. If I may speak eloquently on the subject, this completely sucks for a swing trader like myself, because virtually all the good done last week was neutralized. It would be nice to get a down move that lasted more than, oh, let’s say, a couple of days.

I’ve plucked out some ETF charts below that illustrate something rather consistent: (a) a recent peak (b) last week’s drop (c) this week’s recovery (d) the present price position just underneath a small zone of overhead supply, which is what constitutes resistance. We start with global equities:

Here we have small caps, whose recent consolidation zone was clearly lower than the one in July.

Tech stocks also could not muster enough strength to even match their July highs, and virtually the entire boost this week was from Wednesday (thanks a heap, Jensen) and Thursday.

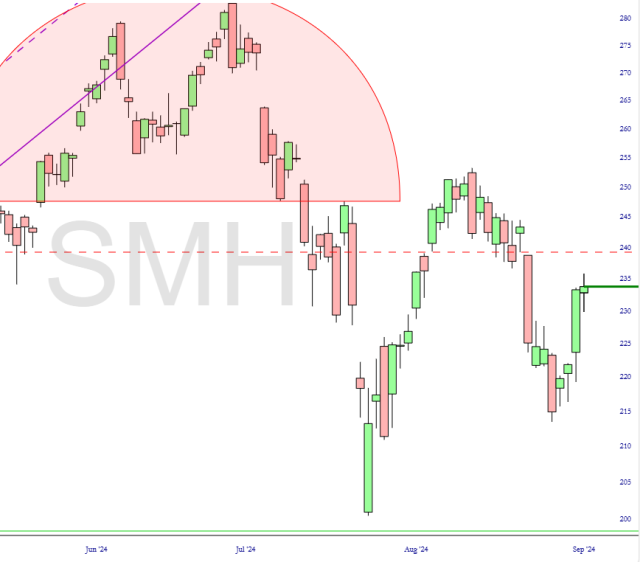

Semiconductors had a particularly explosive Wednesday (again, thanks, Jensen) and stalled out yesterday. Wednesday was easy, because the CEO just had to sling some bluster at a Goldman Tech Conference to cut through the prior Tuesday’s rapid fall, but now we’re back to a very congested price zone.

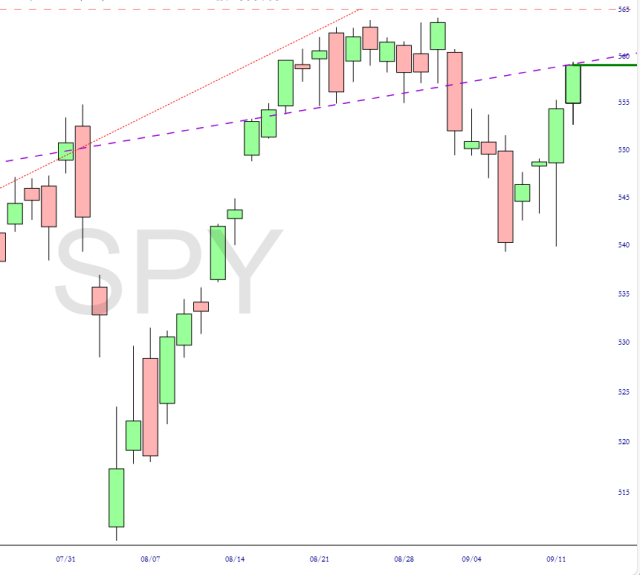

The S&P 500 closed precisely at the midline that I composed an entire post about yesterday.

One of the more intriguing possibilities is the metals fund, XME, which is sporting a much larger and better-formed topping pattern than its brethren above.

As for my own portfolio, I was feeling sensational about things just 48 hours ago, but Wednesday and Thursday were rough. In the midst of it, I kept retreating, and now I’m sitting on a portfolio that’s nearly half cash, instead of the burn-it-all-to-the-ground constitution I had so recently.

I think it’ll be difficult to trade freely and with a clear mind until Bozo does his thing next Wednesday and executes an ultimately meaningless 0.25% rate cut. Until then, tensions continue to run high.