Because, Walk the Line, right? Right? Sheesh. Let’s move on.

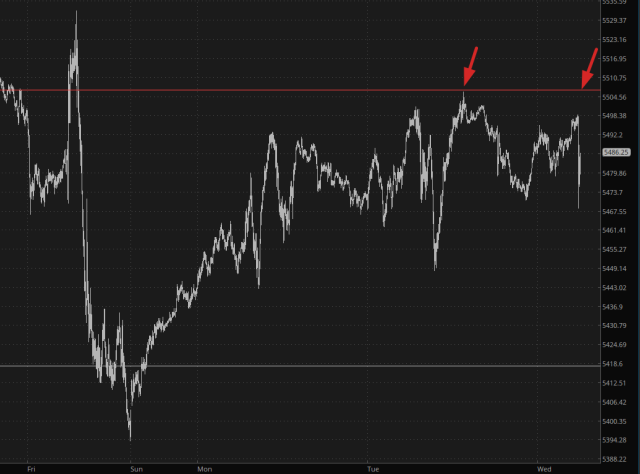

Anyway, the CPI came in right where they predicted for Y/Y and M/M, but the core CPI came in hot at 0.3 instead of 0.2. That’s all it took for folks to lose hope of a 50 bps cut in a week, and thus equities are red right now (although not by that much). The important part is that the resistance line I’ve been yammering on about endlessly held beautifully on the /ES:

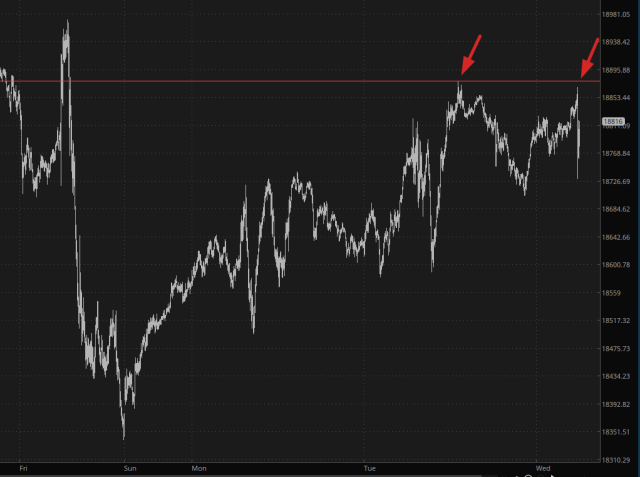

As well as the /NQ futures.

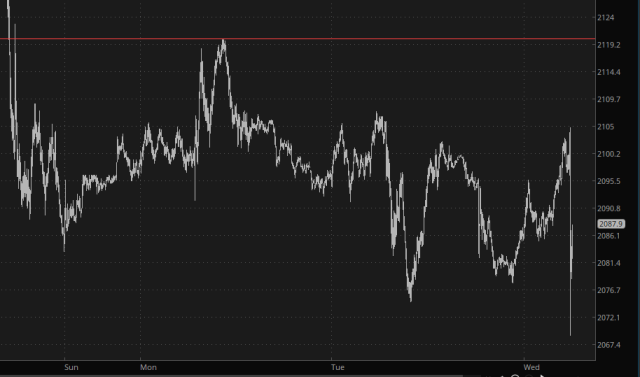

Whereas the small caps, the /RTY, didn’t even get back to the same ZIP code as its own resistance line, so it doesn’t even merit an arrow.

I’ll also mention that crypto continues to hammer out a steady sequence of lower lows and lower highs, which it has done since its lifetime peak on March 14th of this year. I believe this is helping contribute to the moderate “risk off” psyche that’s going around right now.

In the time it took me to compose this post, the equity markets have climbed back to the levels they were at before the CPI even was announced, which shows the Perpetual Bid continues to exist, no matter what. (Had the core CPI come in at 0.1, for instance, I imagine equities would be raging higher at this moment without diminishment). All the same, it’s nice to have this little CPI risk event behind us so we can concentrate on price action until the next nail-biter, which is next Wednesday.