As long-time readers know, I’m no fan of three-day weekends (Juneteenth notwithstanding), and this was no exception. It was particularly irksome since the thinly traded markets decided to tease any surviving bears with a modest sell-off all through Sunday evening, only to have us wake up Monday and watch it march to new recent highs.

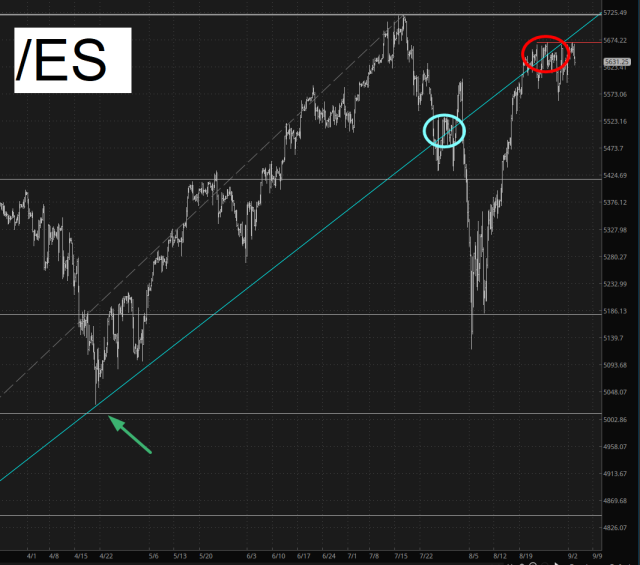

When I went to bed last night, the market was weakening again, and I was naturally concerned (thanks to recency bias) I’d go through the same micro-trauma this morning. Mercifully, once the /ES bounced off its all-important trendline, it slipped straight down. As of now, 45 minutes before the open, it is trying to mount some kind of counter-offensive, but at least we’re read across the board for the moment.

Looking at the bigger picture, you can see how the trendline has evolved since the Halloween bottom. For many months, it has been providing consistent support (green arrow) until it took on some damage (cyan oval), which allowed the market to bang lower until the August 5th low. It bounced powerfully since then, but the trendline had changed roles, and this time, it encountered the trendline as resistance (red oval), which is where it has struggled the past few days and is beginning to show some weakness.

Tech stocks present a similar picture with different shapes. The key here is the mass over overhead supply established in June and July. The latest attempts at a mega-rally completely sputtered out, not even getting into the same ZIP code as the July high, and we’re seeing some selling. The fact that every media outlet is yammering on about how weak September is will probably keep worrying folks as well.

The small caps are a close cousin of the /NQ, since we’ve got the same mass over overhead supply and the same burn-out recently. This red line, however, has more important, since it is a major Fibonacci resistance level. It makes all the sense in the world that the market would be exhausted here and looking to head south.

I am especially short right now, including bearish participation in a sector I haven’t touched in a long time, which is energy. I’m pleased to remind folks that we’ve got a nice, long stretch of trading without any idiotic holidays (unless they come up with Septemberteenth or something) – – just about three solid months of not wasting time. Let’s rock!