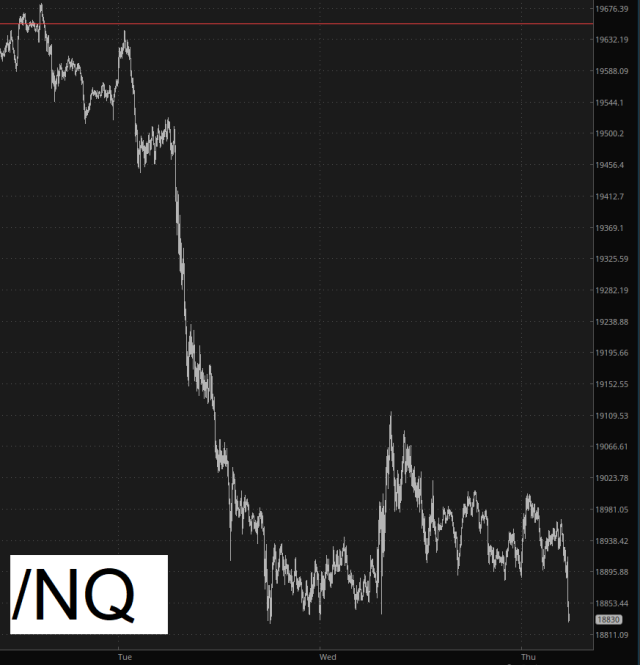

Good morning, everyone, and welcome to the second half of our shortened trading week. As a reminder, the three-legged investment outlook I have is simple: bullish gold, bullish bonds, bearish equities. This week, it is playing out nicely!

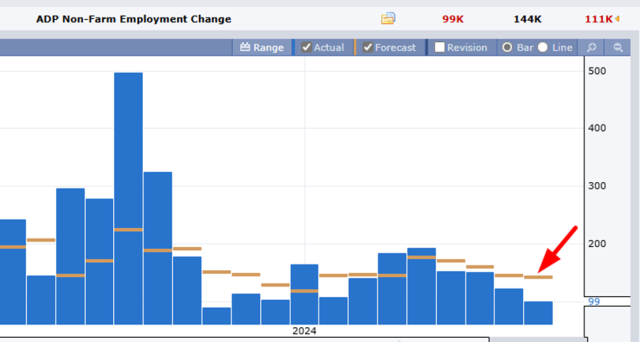

This is being aided this morning by something I anticipated, which is that the jobs market is starting to fall to pieces. The anticipated increase in jobs from the ADP report was 144,000, and we got a BIG miss. Indeed, this is the 4th monthly miss in a row, with this most recent being the largest.

The days of frantic post-Covid hiring are long gone, and we’re going to see millions of jobs lost in the months ahead and the economy tanks into the worst recession in decades.

For the short-term, let’s keep an eye on this price gap as a target for the S&P 500. At some point, the pinheads in D.C. are going to dream up another debt-based concoction to try to breathe life into the wheezing stock market, so we have to remain vigilant. The market WANTS to go lower (a LOT lower), but it’s going to be interfered with every step of the way by self-serving politicians.

May truth prevail! Let’s go get ’em!