Well, I guess the “R-Word” is off limits, so I’ll instead refer to the denizens of WSB as brain-dead. At least until the Association for Brain-Dead Dignity comes after me, at which time I’ll be foreclosed from using the “B-Word.” But, for now, brain-dead it is.

As most of you know (unless you, too, are brain dead) the WSB sub-reddit is crowded with degenerate gamblers and males in a state of arrested development. They are dreadful investors, and their hero is DFV, whose drug of choice, famously, was GME. It was one of those once-in-a-lifetime things, but attempting to behave like DFV is, I believe, akin to modeling yourself after someone who won the lottery. They got lucky, and it’s one-and-done, so it’s all a bit silly. Of course, WSB and its self-deluded victims would not exist were it not for the Fed’s wicked machinations, but this is what we’ve got to work with.

A typical stock that the WSB crowd likes is Roblox, because it’s a colorful game with funny sounds, and that appeals to their stymied intellect. Unfortunately, just because a game is pleasing to the kindergarten mindset doesn’t make it a good investment. Which is where 66% drops in three months come from:

With such investment fixations, you get this kind of loss porn (this took no digging at all; I went over to reddit just now and just plucked them up like leaves around a tree in late November). These are some sample equity curves from the post-pubescent lads hanging out in WSB-land……..

Unfortunately for the other young lads there, notions like “learning from experience” and “not repeating mistakes” are evidently unnatural acts, so they just keep doing the same thing, but with different tickers. Because, you see, the fundamentals of the WSB dream are always the same:

- Find a volatile stock whose earnings are going to be reported;

- Buy a ton of short-dated, OTM options, using all the money in your modest account;

- Pray to whatever deities are available at the moment for the stock to rocket (if you own calls) or crater (if you own puts), ignoring, of course, the enormous premium you are paying based on the well-understood volatility of the stock, which means you’re going to need a fairly epic event to actually turn a profit

On Wednesday, the drug-of-choice was Nvidia, the high-flying graphics card maker founded by Jensen Huang. This company found unexpected success with their graphics cards thanks to crypto, since GPUs tend to be exceptionally good at crypto mining. So here we have a fellow who has self-reported that he is putting his “annual salary” (which is apparently $18,000) into NVDA because the company will “kill it” He makes clear he is “Trusting Huang” to come through for him.

I know the positions are hard to read, but he’s got 62 call options with strikes at 260 and 300 that expire on freakin’ Friday. In other words, they expire within hours of the market’s reaction to the earnings report.

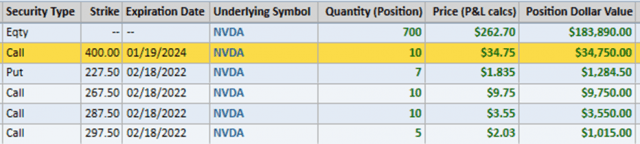

Then there’s this chap who is making a $230,000 bet with options that expire – – yep – – on Friday. He suggests you “wish [him] luck”, which is probably an appropriate plea.

Here is a crisper look at his positions, whose Call strike prices range from $267.50 through $297.50. I’m highly confident whoever this is will speak to his friends about having a “laddered position” and feel quite smug about using fancy-talk.

I probably don’t need to tell you how this movie ends. Earnings came out, the stock popped a couple of bucks higher, and then is started to fade. It was bumping around $258 in the evening session. In other words, it is highly likely that the value of all of the call options I’ve just mentioned will be intrinsically $0.

So what’s all the lesson from all this loss-porn? Simple! Don’t be that guy.